Saturday | January 17, 2026

The Youth of Maxim (Grigoriy Kozintsev and Leonid Trauberg)

Kristin here:

As usual, this end-of-the-year entry has come out early in the next year. I was out of the country for six weeks recently, returning on December 27. It takes awhile to choose ten films, track down copies, watch them, and format the illustrations. For my 1934 list, I complained because I had trouble finding a tenth film. Looking back now, it was a very good line-up. 1935 turned out to be far more difficult. Only a few really obvious films sprang to mind, and the remaining seven are good but not great films. Fritz Lang didn’t make a film that year. Mizoguchi made two films that year, Oyuki the Virgin and The Downfall of Osen. David discusses them in the Mizoguchi chapter of Figures Traced in Light, but he must have watched them in an archive; I couldn’t find anything but unwatchable prints on YouTube.

One problem this year was a lack of decent DVDs and Blu-rays to watch and the take frames from. I try to avoid YouTube, but two films were only available there. Two were only on the Criterion Channel, with no discs available.

At least I can look forward more confidently to 1936. Renoir’s The Crime of M. Lange, Lang’s Fury, Ozu’s The Only Son, and so on. Most of the films below are pleasant entertainment, but hardly masterpieces. I begin with the three best of the bunch, and the rest are in no particular order.

Previous lists can be found here: 1917, 1918, 1919, 1920, 1921, 1922, 1923, 1924, 1925, 1926, 1927, 1928, 1929, 1930, 1931, 1932, 1933, and 1934.

Toni (Jean Renoir)

Toni is an unusual film for Renoir. His earlier films of the 1930s (his La Chienne was on my 1931 list and Boudu Saved from Drowning made the 1931 one) were studio productions with professional actors. In 1956 he wrote of his approach to Toni:

At the time of Toni, I was against makeup. My ambition was to bring the nonnatural elements of the film, the elements no longer dependent on the coincidence of chance encounters, to a style as close as possible to that of daily encounters.

Same thing for locations in Toni, there are no studios. The landscapes and the houses are as we found them. The human beings, whether they are played by actors or inhabitants of Mariques, try to be like the passersby they are supposed to represent: in fact, aside from a few exceptions, the professional actors themselves belong to the social classes, nations, and races of their roles.

The opening of the film, set by a rail bridge by the town of Mariques, near Marseilles, shows immigrants coming from various nearby countries, mostly Italy and Spain, arriving looking for work in the nearby quarry and other industries. Initially the film seems almost like a documentary. One of the workers is Toni, an Italian who rents a room in a boarding house run by a French woman, Marie. The plot develops as he becomes Marie’s lover. He is attracted, however, by a woman at a nearby farm, Josepha. She marries a thuggish supervisor at the quarry, and Toni is resigned to marrying Marie. Despite the real locations and the potential for political treatment of the workers’ lives, the rest of the story is a melodrama dealing with the problems Toni encounters as he is torn between the two women.

Despite the rather bland settings (the film was shot in the autumn), Renoir manages some striking shots. He occasionally uses depth shots, as with a dramatic high angle as Tony talks with his friend on a cliff at the quarry (above). Another depth shot involves an interior shot through a window, with Marie in bed, barely visible in a gap which David would call “aperture framing.” (See also the bottom, with a depth shot after Marie’s suicide attempt.)

Toni is available on DVD or Blu-ray from the Criterion Collection and streams on the Criterion Channel.

An Inn in Tokyo (Yasujiro Ozu)

Not surprisingly, Ozu has become a regular member of the yearly lists. (That Night’s Wife, 1930; Tokyo Chorus, 1931; I Was Born, But …, 1932; both Dragnet Girl and Passing Fancy, 1933; and Story of Floating Weeds, 1934.) He will no doubt return at intervals at least, as long as this series of entries continues.

Sound came late to Japan, and An Inn in Tokyo is his last surviving silent film. It’s main character is Kihachi, the same name as that of the father in Passing Fancy and played by the same actor, Takeshi Sakamoto. He doesn’t seem to be the same character, however, since in the earlier film he had one son, and here he has two. They doggedly follow him as the three walk from town to town. Kihachi is looking for a job in the Depression, and although he says he’s an expert lathe operator, he is rejected time after time. He and the boys resort to catching dogs and turning them in at police stations, because an anti-rabies campaign is going on, with rewards offered for dogs brought in. The boys continue to encourage their father, but he becomes increasingly discouraged. Ozu conveys the days that pass almost identically by showing a variety of similar industrial landscapes.

Ozu’s style is fully developed here. The opening with a large empty drum and cuts to the same drum with the family trudging along the road, seen in long shot and from a low camera height. Shot/reverse shot is done by systematically crossing the axis of action, with the framing creating graphic matches created by the characters’ positions. Low camera height and other familiar Ozu techniques are consistently used.

An Inn in Tokyo streams on the Criterion Channel but for some reason has not been released on disc.

The 39 Steps (Alfred Hitchcock)

Around 1970, when I was approaching the end of my undergraduate career, majoring in tech theater, at the University of Iowa. I took a film history course as the only elective I could find that could fit into my schedule. (Film was in the same department as theater and rhetoric.) Other courses followed and lured me into grad school studying cinema.

I had a lot of catching up to do, watching the classics of the canon as it was at the time. No easy task in those days before home video in the form of VHS tapes, which were only beginning to appear on the scene.

I knew I wanted to see Hitchcock’s work, but the number of his films unavailable for viewing in any format, including 16mm (the norm for classroom use) is startling in hindsight. None of the silent films, few of the 1930s ones, and several of the 1950s films, including Rear Window, Vertigo, and the second Man Who Knew too Much, which were blocked from exhibition by rights problems. I read Hitchcock/Truffaut, which had come out a few years earlier; thus I got a sense of Hitch’s career.

Some readers will remember the impact Charles Champlain’s weekly series Film Odyssey when it was shown on public television in 1972. Twenty-six films, which Champlain discussed afterward with directors and scholars. Fritz Lang appeared to talk about M, Annette Michaelson about Ivan the Terrible Part I and Potemkin, Renoir on Jules and Jim, Grand Illusion and The Rules of the Game, and so on. Basically the list was made up with Janus films, the ones we still see on The Criterion Channel and on the Criterion Collection’s discs. I was one of many whose lives were changed by that series, little knowing that in several years I would write my dissertation on Ivan the Terrible and publish it with Princeton University Press (1981). I still treasure the program booklet, provided free on request from Xerox, which sponsored the series.

Among the films was The 39 Steps. The booklet includes excerpts from some of the interviews, but not nearly all. These are the only way one can get information about who the interviewees were. One fan has listed the films and known interviewees on the Criterion Forum.) Eight films, including The 39 Steps don’t have this information. My vague recollection is that it was considered the best of the series of six films Hitchcock made in the mid- to late 1930s. (I don’t include Jamaica Inn, which I find unwatchable.) That series was The Man Who Knew Too Much (1934, see last year’s ten-best entry); The 39 Steps; Secret Agent (1936), probably the dullest of them; Sabotage (1936); Young and Innocent (1937); and The Lady Vanishes (1938).

With most of Hitchcock’s films now available in some form, we can perhaps see that at least The Man Who Knew Too Much, Sabotage, and The Lady Vanishes are equal to The 39 Steps. (I haven’t watched Young and Innocent recently.)

The film has Hitchcock’s usual blend of suspense and humor that characterize many of his films and especially the ones from this period. The Macguffin is a secret that a group of spies are about to smuggle out of the country. Richard Hannay is forced to try and prevent this by a mysterious lady spy on the British side takes refuge in his flat and explains the smuggling plot. We never learn what the secret it, it being a Macguffin, after all. The lady spy is murdered and Hannay is assumed to be the killer and flees from London to Scotland. He continues his attempt to prevent the smuggling, but the real suspense of the film is built around his repeated narrow escapes from the police chasing him. The Scottish landscapes through which he flees are partly short on location, but quite a few shots were done with rather cheap studio sets; Hitchcock managed to give these a strong atmospheric with lighting, as in the frame at the top of this section.

One police encounter ends with Hannay handcuffed to a pretty blonde who has offered to provide evidence against him. This adds the conventional romantic subplot of a couple who hate each other initially and then cooperate to reveal the real murder and spies. It also provides a little mild risqué humor as the two have to pretend to be a honeymooning couple in order to take refuge in an inn (above).

The 39 Steps is available on Blu-ray and DVD from The Criterion Collection and streaming on the Channel.

Ruggles of Red Gap (Leo McCarey)

My impression is that Ruggles is not thought of as a significant film within academia, which is a pity, as it is a clever, funny film. It was based on Harry Leon Wilson’s 1915 best-selling novel. (P. G. Wodehouse claimed to have invented his character Jeeves because he felt that Wilson had failed to capture the dignity of English valets.) Ruggles was a considerable box-office success and was nominated for a Oscar as Best Picture. It’s score on Rotten Tomatoes is 100% (among critics, the general populace ranks it at 89%). It played at Il Cinema Ritrovato in a 2015 McCarey retrospective in Bologna.

The plot is based around an English nobleman who through gambling loses his valet, Ruggles, to a nouveau riche couple vacationing in Paris. The wife wants Ruggles to dispose of his new master’s loud clothing (above) and dress him in a more dignified fashion. Doing his duty, Ruggles allows the couple to take him to Red Gap, their small town in Washington. He adheres to his valet’s job, doggedly deferring to his employers by refusing when they tell him to proceed them through doors. Once in Red Gap he gradually grasps the American ideal of all people being equal, becomes a popular citizen of the town, and opens a restaurant.

Ruggles is widely viewed as a screwball comedy, which I think is a fair assessment. It follows the common plot premise of rich people being eccentric, often in regard to working-class people. (A model of such a plot is My Man Godfrey, released in 1936.) It’s very funny, due largely to its excellent cast. Charles Laughton was anxious to show that he had a broader range than the villains and scoundrels whom he had played in his most prominent films.

Ruggles is widely available on a variety of streaming services. The DVD from which I took these illustrations is still available. A British Blu-ray from Eureka! is out of print and seems to be difficult to find and expensive when one does. The frames above demonstrate that in this case a DVD is quite acceptable.

A Night at the Opera (Sam Wood and Edmund Goulding)

I thought that Duck Soup (1933) would be the Marx Brothers sole appearance on these lists. The general consensus is that the Marx Brothers’ uncontrolled madness was toned down by Irving Thalberg when they moved to MGM. In a lean year like 1935, however, A Night at the Opera, while not a masterpiece, isn’t out of place in the list.

True, one must sit through two bland musical numbers. Kitty Carlisle at least can act and sing opera, but Allen Jones and his nasal crooning are pretty intolerable and implausible when he impresses a big opera impresario. Moreover, there are the inevitable piano (Chico) and harp (Harpo) solos, this time delivered to cute little children.

Still, setting all this aside, the film has advantages. Zeppo departed the team between Duck Soup and A Night at the Opera. There are two chaotic sequences that live up to the old Marx style: the famous stateroom scene, reaching its most crowded in the frame above. The lengthy interruption and destruction of the opera performance in the climactic scene is hilarious. Groucho is close to his best here, dominating the non-musical-number scenes with constant ad-libs and mugging.

I watched the Warner Bros. Archive Collection’s Blu-ray. (Amazon is even still selling a VHS tape.) The same version streams on Amazon Prime and other services for a small fee.

Carnival in Flanders (Jacques Feyder)

How many people these days knows much of Jacques Feyder’s films? Silent film lovers may be familiar with his 1922 show feature Crainquebille, and Garbo fans recognize him as the director of her elegant 1929 film The Kiss. La Kermesse héroïque remains his main classic of the sound era.

Set in 17th Century Flanders during the Spanish occupation, the film deals with the reaction of a town in the path of an approaching Spanish military group. Fearful of a attack of rapine and pillage, the men of the city timidly come up with a feeble plan to pretend that the mayor has recently died. Scornful of the plan, the women, including the mayor’s wife, decide to welcome the Spaniards with entertainment, food, and in some cases sexual favors. The Spaniards are delighted, enjoy an night of carousing, and move on in the morning.

Feyder saw the film as a farce, and much of it is quite amusing. Still, the idea of the women saving their town by consorting with the enemy adds a sour undertone to the film. Nevertheless, if one ignores this and take it as Feyder intended, Carnival is an impressive film. The action takes place within an elaborate city set by the great designer Lazare Meerson (above and below). The comic scenes are played by an excellent cast, particularly the major stars Françoise Rosay as the mayor’s wife and Louis Jouvet as a cynical Spanish priest.

I have been unable to track down a disc release still in print, but the film streams on The Criterion Channel.

Wife, Be like a Rose! (Mikio Naruse)

Naruse makes his second appearance on the list, after Street without End in 1934. My impression is that a lot of Japanese cinema aficionados view it as his best film of the 1930s.

The plot is handled in an interesting way, with the action falling into two halves. In the first part we meet Kimiko, a modern young woman who claims her salary is bigger than her boyfriend Seiji’s (below). The two bicker and tease each other but are clearly assuming they will eventually marry. Kimiko’s mother, Etsuko, spends her time writing poetry and lamenting the absence of her husband Shunsaku, who has run off with another woman long ago. Kimiko remarks that her mother never paid much attention to her husband. When she sees her father on the street one day, she expects him to visit her and her mother, but he never shows up. Angry, Kimiko takes a train up to a mountain village where her father lives with the other woman.

So far we have seen the situation entirely from Kimiko’s point of view and occasional remarks from Seiji. Once Kimiko reaches the village, she goes into the countryside to see her father. He spends his time panning for gold, hoping to make a better life for his other family, who life a somewhat spartan life. Once Kimiko meets Oyuki, the woman Shunsaku lives with, she realizes that Oyuki is kind and generous and feels guilty about having broken up Shunsaku’s marriage. Although poor, she has been sending money anonymously to Etsuko, money Kimiko had assumed came from her father. The entire situation that had been set up in the first half is turned upside down, and Kimiko finally is convinced that her mother has given him no reason to return and it is better that her father stay as he is.

As usual, the film has echoes of Ozu’s style. The film starts with a shot through a window in an office building (above), a common way Ozu starts his films dealing with characters who work in bland offices. Naruse also uses shot/reverse shots that cross the 180-degree line and creating graphic matches between the two characters, particularly their faces.

He also uses references to American movies, as Ozu does. Here a cover of a fan magazine clearly entitled “Hollywood” (left). Which is not to say that Naruse follows Ozu slavishly. His tracking shots are quite different. In the scene where Kimiko is moved by Oyuki’s description of her happy if spartan home life and her revelation of her sending the money, Naruse uses a tight close-up of the two women, something Ozu would never do.

In a short running time (74 minutes), Naruse leads us to radically change our views in the way that Kimiko does and to sympathize with “the other woman,” who had been vilified in the first half.

Being a sound film, Wife Be like a Rose! is not in Criterion’s Eclipse box set of Naruse’s late silent films, which includes Street without End. The only place I could find it is on YouTube in a so-so print with rather obtrusive large subtitles in black boxes. It’s not available on disc as far as I can tell.

I should add that for mediocre prints like this one, I usually photoshop them, typically boosting the contrast a little and getting rid of any bugs that are present. Wife has a NipponKino logo at the bottom right and little white curved corners, which I also eliminate. The idea is to give a better sense of the filmmaker’s style.

Steamboat Round the Bend (John Ford)

In her excellent new book, John Ford at Work: Production Histories 1927-1939, Lea Jacobs has this to say about the importance of Ford’s actors were one of two vital influences on him: actors and cinematographers:

Obviously Ford’s career may be charted through the stars he worked with and sometimes helped to create. Henry Fonda and John Wayne are the most famous examples, but Victor McLaglen and Will Rogers are much more important for the first half of the 1930s, and their influence on Ford’s œuvre and career remains to be fully explored. (p. 5)

She contributes to that exploration with a chapter on Ford’s three Will Rogers films, Doctor Bull, Judge Priest, and Steamboat Round the Bend. The latter is not a masterpiece on the level of most films that make it to my lists, but Lea assures me it’s the best of the three. I hadn’t watched any of them, so I started backwards and watched Steamboat–not just for this list but in preparation of reading that chapter. (I plan to discus the book in a future blog entry.)

Rogers plays Doctor John Pearly, a snake oil salesman who passes his bottles of Pocahontas as medicine, though it is mainly alcohol (above). This is played for comedy, so that the extremely popular Rogers, with his homespun persona, does not come across as a villain. Apart from making money in this fashion, he decides to overhaul his rundown steamboat and enhance his income with it. When the owner of a fancier boat belittles Pearly’s, the two agree to a bet on a steamboat race, with the winner taking ownership of the other’s boat. A major subplot involves Pearly’s newphew Duke, who shows up with Fleety Belle, whom Pearly initially rejects with scorn as a “swamp girl.” A rapid transformation follows, as a bath and a wardrobe of Pearly’s late wife’s clothes turn Fleety into a spunky, smart young lady whom Pearly admires and even teaches to steer his boat. Duke has been accused of a murder of a man who was trying to force himself on Fleety, and much of the rest of the film involves a search for a witness to the crime who can clear Duke.

The film gives a good demonstration of why Rogers was so very popular. Much of Steamboat has the look of a fairly low-budge film, but Ford pulls out all the stops at the end, with a whole fleet of steamboats participating in the race (more than are visible in the frame below). Naturally Pearly is the one who ends up with two boats, when he runs out of wood and stokes his fire with the remaining stock of Pocahontas–suggesting that he will now give up his old ways and make an honest living.

Steamboat was Rogers’ last film. It was released a month before his death in a plan crash.

Steamboat is available on DVD as part of a set, John Ford at Fox Collection, with all three Rogers films and three other comedies. I haven’t checked the quality of the prints, but it’s a 20th Century-Fox release. Steamboat was earlier also released by itself by Fox. That’s out of print, but there are plenty of copies on eBay. That’s the one I used for the frames above. As far as I can tell, the streaming rights have expired for all the services that used to carry it.

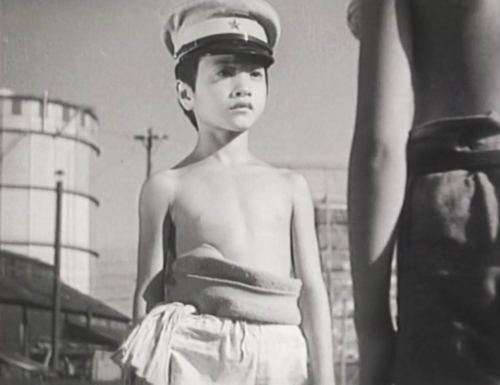

The Youth of Maxim (Grigoriy Kozintsev and Leonid Trauberg)

1935 was not a good year for most of the major filmmakers in the USSR. Eisenstein was struggling with the ill-fated Bezhin Meadow. Pudovkin was accused of formalism for Deserter (1933), and combined with health problems, his next film was not released until 1938. I haven’t been able to find a watchable version of Dovzhenko’s Aerograd, but friend, colleague, and Dovzhenko expert Vance Kepley assures me that it does not belong on a ten-best list.

Kozintsev and Trauberg have been on the list previously (The Overcoat, 1926; New Babylon, 1929; and Alone, 1931).

The Youth of Maxim is the first of three films, The Youth of Maxim, The Return of Maxim (1937), and New Horizons (1939). These were loosely based on the life of writer Maxim Gorky, presumably derived from his fictional set of memoirs, My Childhood, In the World, and My Universities (1913-1923). The films do not reflect Gorky’s actual life, however. The future author had a miserable early life, orphaned at a young age, wandering across Russia from job to job, and even attempted suicide. (“Gorky,” an assumed name, means “bitter.”)

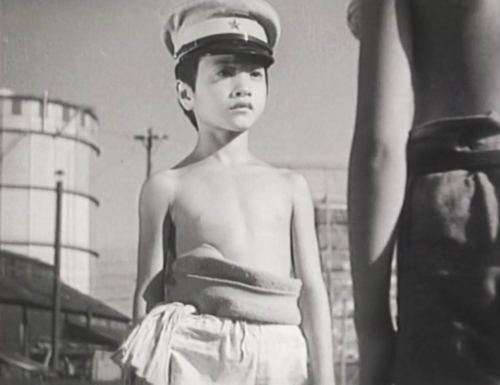

By contrast, in the first film, Gorky is a carefree young man with a factory job and a girlfriend. We first see him singing a cheerful song with his two friends. The year is 1910, but Gorky has no knowledge of workers’ rights or a coming revolution. The arc of the plot is conventionally Stalinistic. The death of one of the friends in a factory accident begins to alert Gorky to the dangers workers are exposed to and the indifference of the owners to such a minor problems. A second death (above) lingers over the workers grief and anger, and Gorky begins to realize the resistance is necessary. Ultimately at the funeral procession for the dead man, the workers treat the occasion as a protest march, watched by the owners and a military presence (see top). When a riot breaks out, Gorky finally commits to the workers’ cause and joins in the fighting, ending up in prison.

This film and the two that succeeded it were both considered acceptable to the regime, and in 1941 the two directors were awarded the Stalin Prize.

The only place I could watch the film was on the RVISION channel on YouTube, with subtitles. It’s a so-so print, reasonably good in some scenes and poor in the darker ones, including the lively opening that seems to have echoes of New Babylon.

Two experimental animated shorts in color:

Composition in Blue (Oskar Fischinger)

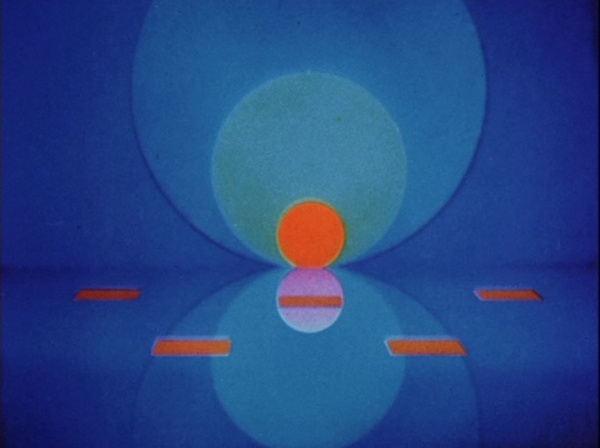

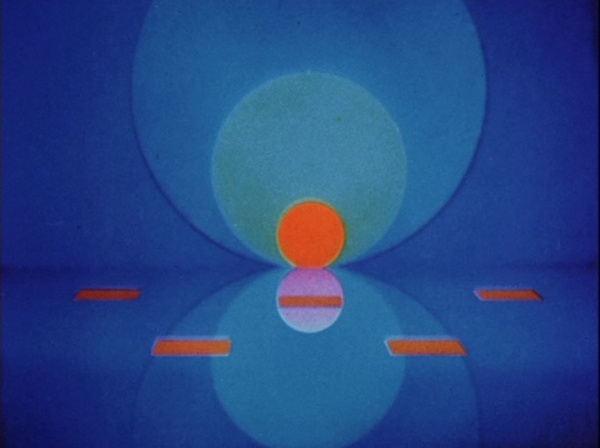

Fischinger began his career making black-and-white abstract animated film synchronized to musical pieces. A group of these Studies were included in a section on experimental cinema in my 1930 list. During the 1930s Fischinger participated in the development of a color system called Gasparcolor, which he first used in one of his ads for Muratti cigarettes, Muratti geift ein (1934) and some animation tests. His first exhibited experimental film using the system was one of his major animated works, Komposition in Blau, at four minutes. It is done in stop-motion rather than with drawings. Most of the little shapes that move about via stop-motion are objects.

The film was shown at a theater in Los Angeles, leading Paramount to hire Fischinger. His move to the US was permanent. His work there culminated in his most ambitious project, Motion Painting No. 1 (1948).

Composition in Blue is available from the Center for Visual Music on one of the two discs of his work: Oskar Fischinger: Visual Music.

A Colour Box (Len Lye)

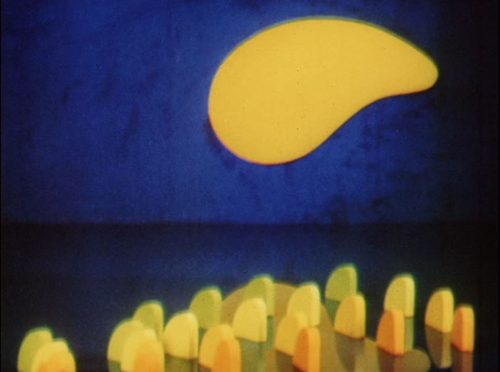

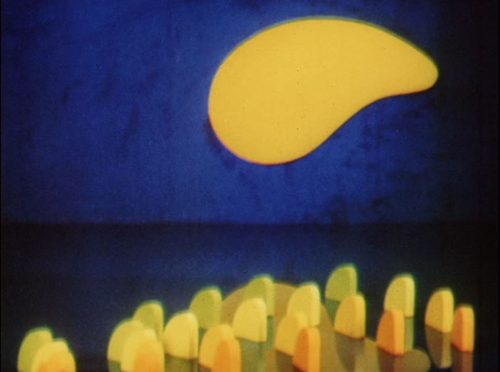

Coincidentally, in 1926 New Zealand avant-garde artist Len Lye had moved to London and in the 19302 started work for John Grierson’s Film Unit within the General Post Office. His first two four-minute color shorts, both made in 1935, were Kaleidoscope and A Colour Box. Rather than using stop-motion to manipulate colorful objects, he painted shapes directly onto clear 35mm film. The result was a pair of abstract animated films that ended with a brief passage of words and numbers aimed at promoting the G.P.O.

Both shorts were made using a different early system called Dufaycolor. It seems to have had a narrower range of colors than Gasparcolor, which Lye switched to for his next films, including the marvelous Rainbow Dance (1936)–which might well make it to next year’s list.

A DVD collection of Lye’s shorts called rhythms has been sold in the past by the Center for Visual Music, but the shop lists it as sold out, which seems to be permanent. Canyon Cinema has the same DVD for sale.

Thanks to Vance Kepley, Lea Jacobs, and Ben Brewster for help with this entry.

The quotation from Renoir is from the notes included in the Criterion disc of Toni, which also contains a useful essay by Ginette Vincendeau

Toni

Posted in Film comments |  open printable version

| Comments Off on The ten best films of … 1935 open printable version

| Comments Off on The ten best films of … 1935

Monday | October 6, 2025

Kristin here–

Loyal readers of this blog checking back at intervals in the hope of finding a new entry will not have found one for quite some time now. Indeed, the last entry was posted in March, and just over half a of silence.

This lack of new entries does not reflect a decision to bring the blog to an end following David’s death. One might say it has fulfilled its purpose, having started in September of 2006 and reached 1,113 entries. It contains an enormous amount of information about the industry and close analysis of a huge number of films.

Coming up with new ideas for entries will be more difficult now. Part of the fun and inspiration of working on the blog was reading and commenting on each other’s drafts. Many topics came from our visits to film festivals. I have to admit that I’m not keen on attending those alone, though I may eventually do so.

Part of the silence has been due to a busy year focusing on my other obsessions. I’ve been to Egypt twice already and will be going twice later this year. The director of the expedition at Tell el-Amarna, where I work on royal statuary and other hard-stone decorative objects, died last year. After some uncertainty, the new director has been able to organize two seasons this year. I was on the site for three weeks in April-May and will be there for two weeks in December.

Beyond that, I am a big fan of British artist J. M. W. Turner, and this is the 250th Anniversary of his birth. I’ve been to seven exhibitions in England and the USA and have three more planned.

On top of all that, I had a knee replacement in mid-August. Now, six weeks later I am able to drive a car and walk down stairs. Almost recovered!

Next year should be calmer, though maybe not much calmer.

Occasionally I will no doubt get ideas worth writing up. Plus David might be gone, but news concerning him will not end. Publications dedicated to him and honors of various sorts are already in the works, and I will be happy to announce them here. As always, I will link to new entries on my Facebook page.

This entry is one example of such announcements. It deals with two posthumous pieces that reflect David’s love for Wes Anderson’s films.

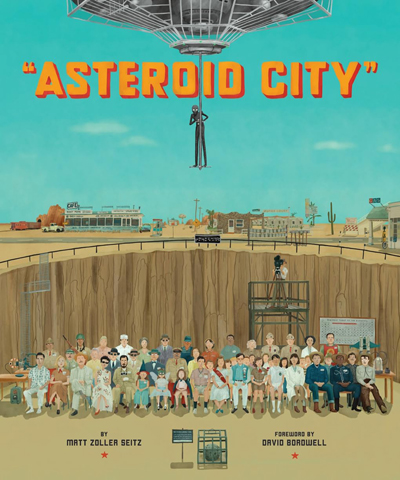

David joins The Society of the Crossed Pens

In 2013, Abrams brought out a hefty coffee-table book, The Wes Anderson Collection. It dealt with all of the director’s features to that point, from Bottle Rocket to Moonrise Kingdom. Each film was accorded a brief essay by editor Matt Zoller Seitz and an interview with Anderson, with the number of words per each given at its beginning. The collection hit a balance between informing and entertaining the reader. At $50 (or at least that’s what Abrams’ website charges now) it’s a bit steep for all but devoted fans. I don’t know what reaction Abrams executives expected, but it must have sold very well. The publisher decided to issue a similar, though slimmer, book on each film that followed Moonrise Kingdom, that being The Grand Budapest Hotel.

David discussed The Wes Anderson Collection briefly in a blog on the rise of “The Massive Auteur Monograph” in 2020.

We had known Matt for some time at that point. In 2007 David complimented a review of Johnnie To’s Exiled that Matt had written for the New York Times. Matt responded, and a friendship began. David met him at Ebertfest in 2010, where David was presenting Apocalypse Now Redux. I met him the next year at the same place, where I introduced and ran a panel on the restored Metropolis. Thereafter we have crossed paths with Matt, though all too seldom.

There had been no separate book on Moonrise Kingdom, which was a pity. It is David’s and my favorite Anderson film, though Asteroid City runs it a close second. It featured prominently in David’s entry on secondary worlds (“Wesworld”) on November 5, 2015. Before that, on July 20, 2014, he had posted a long, brilliant analysis of it, “MOONRISE KINGDOM: Wes in Wonderland.” That stands in for the one for which there was no book.

Matt no doubt noticed that David was blogging enthusiastically about Anderson’s films and invited him to write an essay for the first single-film book, on The Great Budapest Hotel.

As David pointed out in a brief post when the book came out, “The Grand Budapest Hotel volume assigns contributors the role of concierges (“The Society of the Crossed Pens”). A page with that heading is included in the back, with all the contributors shown as illustrations by Max Dalton. David’s extra wide image reflects his analysis of the shifting aspect ratios used in the film (above); the five other author cartoons are vertical. Shown the caricature ahead of the book’s release, he of course blogged about it:

All the authors of pieces in Matt Zoller Seitz’s forthcoming Grand Budapest Hotel book are given the Max Dalton treatment, in the vein of The Wes Anderson Collection. Herewith, the contributor portrait of your obedient servant. And in Cinemascope!

Yes, I am happy. Yes, it’s a credible likeness. Yes, said book is due out on 10 February from Abrams. No, I will not be getting a tattoo of it.

After the Grand Budapest book came out, complete with his insightful essay, David discussed it in a blog entry on March 29, 2015.

The next book, on The Isle of Dogs, had a different format, with mostly long interviews and images from the production. David was not involved in it.

The format returned to normal for the Abrams book on The French Dispatch of the Liberty, Kansas Evening Sun. David managed to untangle the difficulties of this challenging film in his usual masterful way. When a copy of the book reached us, we discovered that it had been dedicated to David and me. An honor indeed. (More on David’s essay in the section below.)

Once again Matt invited David to contribute an essay to the Asteroid City book. This would have been late in 2022 or early in 2023, I believe. Although the film itself was platform released on June 16, 2023 and went wide June 23, 2023, clearly David would not be able to go to a theater to see it. (He went into hospice care at home in late August.) Matt arranged with Wes Anderson’s office for David to be given online access to a streamer in March and requested two renewals of the access for repeat viewings. We watched it together, and both of us loved it. David couldn’t wait to say something about it, so he posted a brief blog entry on it in May.

For some reason that I don’t remember or didn’t know, David decided he would rather write a Foreword to the book than the usual essay. I think this was probably because he expected that this would be the last of these essays that he would be able to write. In a Foreword he could write a summary of his view of Anderson’s overall stylistic approach across his career before launching into a discussion of the film itself. The Foreword is called “The Stubborn Stylist’s Space Adventure.”

I don’t know whether David thought of it, but writing a Foreword meant that his name is on the front cover of the book.

The piece begins, “In the history of cinema, it’s rare of find directors who persist in the sort of strongly individual styles that we can spot across, say, the history of painting. The supreme example is probably Yasujirō Ozu, who for thirty years clung to unusual techniques of staging, framing, and cutting. Other examples include Robert Bresson, Jacques Tati, and Béla Tarr.”

I don’t think David is saying that Anderson is as great a filmmaker as those giants, though at some point we may decide that he comes close. But he does go on to say, “Wes Anderson is one of those stubborn stylists.” This isn’t a qualitative judgement but a declaration that here is a director who has a distinctive style and sticks to it and that’s interesting. There aren’t that many who do.

After a little over two pages, David switches to how that distinctive style manifests itself in Asteroid City, and of course he gives as cogent an analysis as he did with The Grand Budapest Hotel and The French Dispatch.

The Blu-ray of the film came out on August 15, 2023, twelve days before he went into hospice care. I don’t know how many times he watched it in the six months he lived thereafter, but it certainly was more than once, beyond the original screener viewings. Being bedridden is boring, and David watched many films and TV series, but I am glad that he had this particular one for entertainment.

The publication date of the Asteroid City book was January 28, 2025. David had died nearly a year earlier, but he knew it was coming. I discovered that the book was out during one of my trips to London in the spring, where I visited Fantastic Planet and saw a stack of them in a bookcase labelled “Cult movies.”

For Abrams’ webpage of all the books in the series, see here.

In the “About the Contributors” page, the brief biography of David ends, “His contribution to this volume is his last published work.” As far as I know, that’s true. Still, there will be reprints and translations as David’s impact on film studies continues. I have added “David Bordwell” as a new Category in the right margin.

From essay to video

Recently The Criterion Collection has released a set of ten Anderson films, from Bottle Rocket to The French Dispatch. (Focus has released Asteroid City and The Phoenician Scheme.) Each film has two discs, Blu-ray and 4K UHD, as well as a small pamphlet with credits and a short essay on the film. These come in little what appear to be books in a handsomely designed flip-top box. I have watched all the Blu-rays, and they look great.

While this set was in the making, Criterion contacted me about whether I would approve of their taking David’s essay, “No Crying: How to Overcome Blasé Ennui,” in the Abrams French Dispatch book and turn it into a video essay. The idea was to have an actor read the entirety of the text, and Susan Arosteguy and the Criterion team would add clips and frames to turn it into an essay somewhat like the ones in our “Observations on Film Art” series on the Criterion Channel. I OKed the project, and obviously the film’s rights’ holders did. I think the result is excellent. That essay is quite extraordinary and a big help understanding a very complex film.

So it’s not strictly a new essay, but for those who don’t read the Abrams books, it’s another brilliant analysis by David.

Posted in David Bordwell, Directors: Anderson, Wes |  open printable version

| Comments Off on David and Wes open printable version

| Comments Off on David and Wes

Tuesday | March 4, 2025

Kristin here:

Students and faculty in the film-studies division of the Department of Communication Arts at the University of Wisconsin-Madison are known for aesthetic analysis of films and historical study of the film industry. One aspect of the latter has been the study of franchises. Long ago Henry Jenkins coined the term acafan, defined as someone who is a fan of what he or she studies but also produces academically solid publications on it. His Textual Poachers (1992, second edition 2012) became a classic in the study of fandoms. His Convergence Culture (2008) examined the relationship between fandoms and film, television, and other media franchises.

Henry studied under David here at the university. I think it’s safe to say that David was also an acafan when he wrote about Asian action cinema in Planet Hong Kong (2000, second edition 2011, available as a PDF here). I, too, admitted to being an acafan when I wrote my study of Peter Jackson’s (or should I say New Line’s) Lord of the Rings films in The Frodo Franchise: The Lord of the Rings and Modern Hollywood (2007).

In 2016 I took a look at the continuation of the LOTR franchise, which was still going strong then and is still going strong now. No doubt next year, when we reach the twenty-fifth anniversary of the release of The Fellowship in the Ring, there will be considerable exploitation of re-releases and yet more licensed products.

More recently Colin Burnett, another of David’s students, known for his study of Robert Bresson, has turned his enthusiasm for the James Bond franchise into a research project. I am happy to see him discovering shifts in control of the film and merchandising rights that somewhat parallel those in the LOTR franchise, most notably with Amazon’s ambitious prequel series, The Rings of Power. Thanks to Colin for contributing an entry dissecting and clarifying the recent Variety article announcing Amazon MGM’s acquisition of the Bond film franchise.

Amazon Doesn’t Own James Bond–Yet

In a development that has shocked the entertainment industry, Amazon MGM announced on February 20, 2025 that it had taken over “creative control” of the James Bond film franchise. What exactly does this mean, and why is it so shocking?

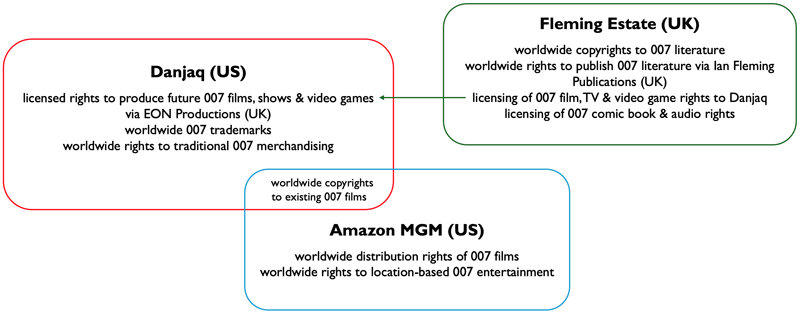

Reporting on the news has tended to overlook some crucial details about the structure of the Bond franchise, a factor which in turn has colored the speculations of commentators and fans. Variety’s February 20 headline, for instance, alleges that “Amazon MGM gains creative control of 007 franchise.” This simply isn’t the case.

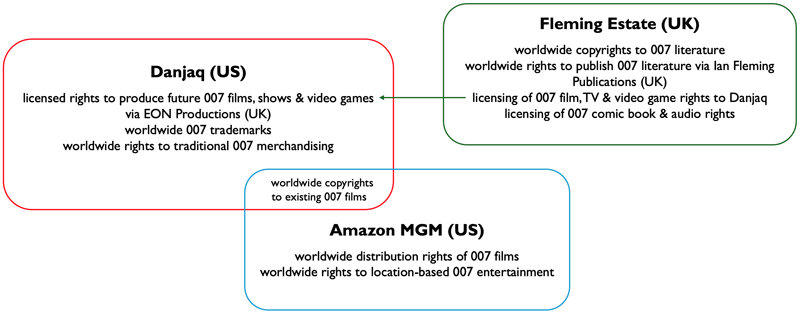

The Bond franchise is configured as a shared rights and licensing network (above). For decades, even prior to Amazon’s acquisition of the studio in 2022, MGM has owned the worldwide distribution rights of the Bond films, as well as shared copyrights for the existing Bond film titles. The new pact, which some price at $1 billion (unconfirmed), gives Amazon MGM the power to manage the artistic direction of the film series for the first time, and thus presumably a controlling stake in a company called Danjaq.

How did we get here?

Danjaq/EON Productions’s shifting media franchising strategy

Until now, production of the film series has been in the able hands of the Broccoli family. In 1961, producers Albert R. “Cubby” Broccoli and Harry Saltzman optioned Ian Fleming’s novels and formed Danjaq, a rights holding firm initially based in Switzerland (now in the US). To produce their Bond film series, Broccoli and Saltzman acquired the small British production company EON Productions, allowing them to benefit from British tax breaks and subsidies. They also formed a partnership with Hollywood studio United Artists (UA) to finance and distribute their projects. Over the years, there have been changes here and there—MGM acquired UA in 1981, and Broccoli’s stepson Michael G. Wilson and daughter Barbara Broccoli took the reins of EON/Danjaq in 1995—but the EON/MGM arrangement has remained relatively stable.

The decades-long partnership between EON and MGM has always favored the Broccolis. Through EON, they shaped the creative direction for the series, and through Danjaq, the Broccolis managed the copyrights for the cinematic Bond and the global Bond trademarks. But when the multinational technology company Amazon purchased MGM in March 2022, it acquired considerable leverage in the Bond franchise. Almost immediately, tensions began to surface between EON and MGM. The longtime partners couldn’t agree on the next steps for the series.

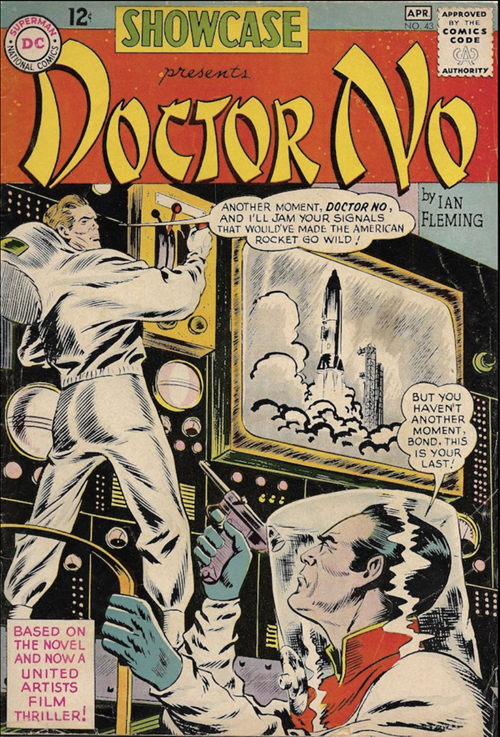

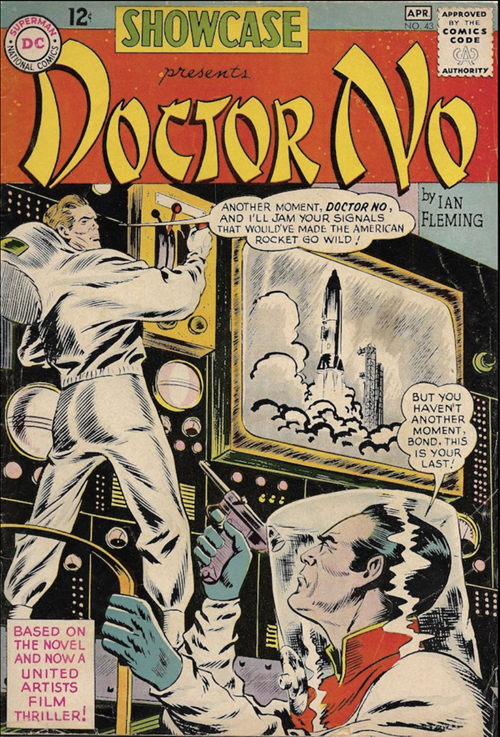

Reports indicate that Amazon MGM was intrigued by the possibility of a James Bond Universe akin to Disney’s Marvel Cinematic Universe and Star Wars Universe. The concept is not a foreign one to Bond producers. Between 1961 and 2002, EON worked with partners in numerous popular media to spread the Bond story throughout the market. They licensed publishers DC, Dell, Marvel, and Topps comics to adapt their films into comic books, such as the 1962 DC Showcase 32-page comic book adaptation of the film Dr. No.

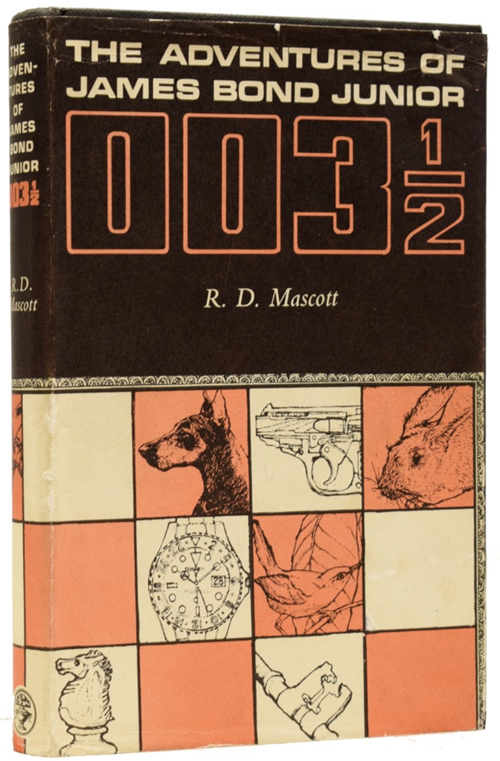

In the 1960s, they showed interest in a children’s TV series based on the 1967 novel The Adventures of James Bond Junior 003 ½ , published by Ian Fleming publisher Jonathan Cape. The concept came to fruition with the syndicated show James Bond Jr. (1991-1992).

In the early 2000s, they started development on a spinoff film titled “Jinx,” based on the Halle Barry character from the 2002 film Die Another Day. And for decades, EON has worked with video game designers to create interactive adventures, the most famous being GoldenEye 007 (1997) for the Nintendo 64 system. In fact, there’s a new EON-licensed game in the works.

In recent years, EON has devoted most of its resources to the films, whose productions became more ambitious. Perhaps sensing Bond’s uniqueness in the market, where franchises saturate consumers with content—Marvel and Alien movies and streaming series, Star Trek shows, Star Wars games, Avatar comics, etc.—EON opted for a more restrained approach that focused on films, creating the impression that they were “specials” and avoiding product overexposure. There have been exceptions. When the Daniel Craig era came to an end with 2021’s No Time to Die, EON signed with Amazon Prime—prior to the Amazon’s acquisition of MGM—to partner on the reality show 007’s Road to a Million. The series required little creative investment on Wilson’s and Broccoli’s part, and Bond doesn’t appear in the show, protecting EON’s most valuable commodity.

Amazon MGM’s notion of a cross-media Bond Universe simply didn’t appeal to EON, and the development of a series to follow the Craig films stalled. Exacerbating the situation, reports are that EON was flummoxed about how to relaunch the films after the creative and financial triumphs of the Craig era.

Why did EON step away?

Commentators have alleged that these creative impasses placed pressure on Wilson and Broccoli to sell their creative stake in the film series. But other developments suggest that the picture is more complicated.

Media franchises like Bond, the Lord of the Rings, Oz, and Marvel are all about rights. In recent weeks, peculiar news has surfaced in The Guardian (UK) about an Austrian-born developer named Josef Kleindienst, owner of a luxury property empire in Dubai, filing a number of “cancellation actions based on non-use” in UK and European courts. His ambition is to claim ownership of a broad swathe of Bond trademarks. These trademarks—for such items as computer programs, electronic comic books, electronic publishing and design—have not been used for a period of five years. Kleindienst is alleging that Danjaq’s trademarks for “James Bond Special Agent 007,” “James Bond 007,” “James Bond,” “James Bond: World of Espionage,” and the expression “Bond, James Bond” are subject to challenge.

These legal challenges, assuming they have standing, would have placed EON/Danjaq in the difficult position of having to battle a well-resourced foe in court or to quickly roll out product to renew their trademarks. A loss of even some of these trademarks could be devastating for the franchise. Acquiring the trademarks would not be easy, but were Kleindienst to succeed, he could at least in theory challenge or seek compensation from the production and release of any product seeking to use the James Bond name. Perhaps Wilson and Broccoli elected to sell their controlling stakes in Bond to avoid a protracted legal battle. Perhaps, too, the multi-billion-dollar firm Amazon MGM stepped in, and agreed as part of the deal to fight these impending trademark challenges to keep all Bond rights under the EON-MGM tent.

If such speculation has merit, then Wilson and Broccoli ceded creative control because it was their only major bargaining chip with Amazon MGM. The deal would ensure their continued roles as stewards of their portion of the Bond rights. After all, even EON/Danjaq doesn’t own all of the Bond intellectual property. The literary, audio, and comics rights are retained by the Ian Fleming Estate and managed by the firm of Ian Fleming Publications (IFP). In a statement issued on its website, IFP addressed the Amazon MGM deal, acknowledging Wilson and Broccoli “for their remarkable stewardship and vision. Their imagining of James Bond on screen has created one of the world’s great film franchises and has led the incredible success of the British film industry.”

What lies ahead for 007?

Here too there’s much speculation. Most fans of the film series seem skeptical about the new Amazon MGM era, concerned that Bond will become just another media franchise. An Ellis Rosen New Yorker cartoon captures the general mood, showing Jeff Bezos—in the guise of Bond villain Ernst Stavro Blofeld—standing over a bound James Bond who lays prone under the Amazon Swoosh symbol in a position reminiscent of the famous laser-torture sequence from 1964’s Goldfinger. In the original, Sean Connery’s Bond says to rival Auric Goldfinger, “You expect me talk?” Goldfinger’s answer is iconic—“No, Mr. Bond, I expect you to die!” In the New Yorker version, Bezos responds, “No, Mr. Bond, I expect you to star in a series of increasingly bland spinoffs and TV shows that have significant viewership decline after the first episode.”

One thing’s for certain: Bond has entered the “content” era. The film franchise will no longer focus on films alone. Given its extraordinary resources, Amazon MGM may even make a bid for all Bond rights, including a buyout of IFP, bringing the Bond property under one rights-holding company for the first time since the 1950s.

In the meantime, will Amazon MGM respect the Bond film property? Will it treat the replacement of Craig with the same care EON addressed the “new Bond” question in the past? Will it pursue EON’s commitment since the onset of the Craig era to “quality” blockbuster production, with an emphasis on location shooting, practical effects, and adherence to the spirit, if not the letter, of the Fleming version of the character? I have reasons to doubt some of this.

Among other concerns, the copyrights to Ian Fleming’s original Bond stories expire in the UK in 2034, a date that marks 70th anniversary of the author’s death (Fleming’s works are already in the public domain in Canada.)

Amazon MGM has just under a decade to exploit the Bond film rights before competitors are legally able to launch their own adaptations of Fleming’s 007. We can expect more studio-bound, computer-generated (CG) productions, which is more efficient than the location-based approach of EON and today drives most major franchise filmmaking. We can also expect streaming series: a Felix Leiter series, a Moneypenny series, or perhaps a Lashana Lynch 007 series or a Jinx series. Perhaps we can expect Amazon MGM to option a number of the “Bond Continuation” novels released by IFP since Ian Fleming’s death in 1964. Most assuredly, we can expect a “mothership” theatrical series with a new Bond, and even a revival of the James Bond Jr. animated series, for which some fans are nostalgic. Amazon MGM will do many of the things EON/Danjaq did or had hoped to do in the past but didn’t have the resources or bandwidth to do in recent decades.

We can expect, in short, what we’ve come to expect, over and over again. A new Bond era.

For more on EON Productions and its reliance on British film subsidies, see pages 41-42 and 55-56 of James Chapman’s Dr. No: The First James Bond Film (New York: Wallflower Press, 2022). See also Charles Drazin, A Bond for Bond: Film Finances and Dr. No (London: Film Finances, Ltd., 2011).

For a detailed account of the original deal between EON and UA/MGM, see chapter eight of Tino Balio’s United Artists, The Company that Changed the Film Industry, Volume 2, 1951-1978 (Madison, WI: University of Wisconsin Press, 1987).

Colin Burnett is Program Director and Associate Professor in the Film & Media Studies Program at Washington University in St. Louis. He is the author of two books, including one on the major French director Robert Bresson. He has written an article on storytelling in the James Bond film series for the Journal of Narrative Theory and is completing a new book entitled Serial Bonds: The Shape of 007 Stories.

Posted in Film Franchises, Hollywood: The business |  open printable version

| Comments Off on Amazon Doesn’t Own James Bond—Yet: Making Sense of the 007 Franchise. A guest post by Colin Burnett open printable version

| Comments Off on Amazon Doesn’t Own James Bond—Yet: Making Sense of the 007 Franchise. A guest post by Colin Burnett

Thursday | January 23, 2025

I dimly remember hearing in late 2020 that the sequel to Moana (2016) was going to be Moana: The Series, streaming on Disney+ rather than a theatrical feature. David and I liked Moana very much, but in those of Covid and non-theater-going, it seemed a minor thing. A series wasn’t appealing, and we could just ignore it. Then about a year ago it was re-announced as a theatrical feature. I just assumed that the powers-that-be had simply decided that what was by that time being called Moana 2 would make more money by being released “Only in theaters,” as the posters inevitably pointed out.

That was true, but there’s much more lurking behind such a decision. Straight to streaming or released to theaters first? has become a puzzling question for studios as they discover that the huge profits they assumed their new streaming services would bring in were not all that huge or maybe not profits at all.

I am delighted to have two experts, Nicholas Benson and Zachary Zahos, who follow the distribution strategies of the film industry, contribute a guest post on how Moana 2’s change from modest Disney+ series to a box-office hit creeping up on the total domestic gross of Wicked reflects major shifts in the industry’s decisions about releasing options.

Nicholas Benson received his Ph.D. in Media and Cultural Studies from the University of Wisconsin-Madison and is now an Assistant Professor in the Department of Communication and Media at SUNY Oneonta. His current work considers the intersection of discourses of storytelling and management within franchise production cultures. Zachary Zahos also received his Ph.D. from the University of Wisconsin-Madison and is currently serving as Public History Fellow at the Wisconsin Center for Film and Theater Research. Back in September Zach and Matt St. John contributed a entry to this blog, examining a claim that movie lovers had stopped going to theaters.

Thank you, Nick and Zach, for your contribution to our understanding of the current tangled distribution systems of the current industry! Over to you.

The curse has been lifted—at Walt Disney Pictures.

After a run of box-office bombs, Disney’s flagship film studios bounced back in 2024: Pixar with Inside Out 2, 2024’s top-grossing film, and Walt Disney Animation Studios with Moana 2, which just cleared $1 billion globally. Even Mufasa: The Lion King, a CGI prequel produced by Disney’s live-action division, looks destined to overcome a weak start to become a profitable “sleeper hit.”

The cynical read on all this is that Disney, to quote The Town’s Matt Belloni, “engineered” a surefire 2024 by pushing riskier bets, such as Pixar’s Elio and the Snow White remake, to this calendar year. But, at the end of the day, adaptive engineering, risk mitigation, studio chicanery, whatever you call it—this is how Hollywood lives to tell another tale, and you need not look further than Moana 2 for a revealing case of Disney executives reading the horizon and changing course.

Moana 2’s present status, as a resounding theatrical success, interests us in particular due to the roundabout journey—and P.R. spin—it took to get here. For those unaware, the film now playing in multiplexes called Moana 2 was greenlit in 2020 as a television series (titled Moana: The Series) for the company’s streaming platform Disney+. It was only last February when CEO Bob Iger announced that this project was instead heading to theaters under the new title Moana 2. While the trades were quick to discuss the financial calculus behind such a shift (per Deadline: “after misfires … more Moana is a safe bet for the House of Mouse”), Disney has been careful to publicly attribute this decision to creative, rather than business-minded, imperatives. For instance, Jennifer Lee, former CCO at Disney Animation, told Entertainment Weekly in September:

We constantly screen [our projects], even in drawing [phase] with sketches. It was getting bigger and bigger and more epic, and we really wanted to see it on the big screen. It creatively evolved, and it felt like an organic thing.

As genuine as this sentiment might be, we sincerely doubt that Moana 2’s last-minute about-face, from streaming series to theatrical film, emerged from creative disagreements alone. The film industry has changed rapidly over the last five years—streaming has undergone its own boom and bust cycle during this time, with vintage concepts like advertising, bundling, and return-on-investment, bringing Hollywood executives down to earth. In short, the Walt Disney Company that announced Moana: The Series in 2020 is different from the one that released Moana 2 in theaters last month.

Longtime readers will recall this blog’s fondness for the first film, as shared by David, Kristin, and Jeff Smith. We count ourselves Moana fans, as well, while also agreeing with critical consensus that Moana 2 lacks the inspiration (or songs) of the original.

But what follows is not a review. While we will make reference to certain storytelling choices present in the film, our main goal here is to argue that Moana 2—or, more specifically, the production and circulation context surrounding it—is symptomatic of a global industry in flux. As the world’s largest legacy entertainment company, Disney is not one to buck trends but rather to reinforce them. An engaged analysis of Disney’s recent executive-level decisions offers us a chance to gauge which way the winds of commerce are blowing.

Yet the company’s sheer scope, both internally and across its multi-generational audiences, invariably creates sites of tension and contest. We see that in Jennifer Lee’s public assurances concerning Disney’s creative community, and not its C-suite, steered Moana 2 into theaters. But we also see such tension and contest in how Moana 2’s production history throws long-standing hierarchies at the Walt Disney Company into relief. As a result of Disney+ and recent executive initiatives which we will delve into here, the line separating the company’s film and television output has become increasingly blurred, as have the rules for successfully exploiting marquee franchises, particularly those geared toward younger audiences.

What is clear to us is that, even in success, Disney+ has failed to solve all of its parent company’s problems and in the process has created several new ones. This is not simply because of profit margins, but also because such investments, from both studio and audience, run downstream from discursive categories like “film,” “television,” and “streaming.”

In the case of Moana 2, the shift of Disney’s prized sequel from the “streaming television” to the “theatrical film” column, months out from release, occurred in large part due to the promise of greater financial returns. That much seems obvious, no matter what Jennifer Lee and other creative executives say, given how most studios across the industry have learned to love movie theaters again.

But we do not wish to suggest these leaders are lying through their teeth, either. As strategic as Lee’s statement to Entertainment Weekly may have been, she does seem to genuinely represent the values and norms of the world’s most famous animated film studio. Where else but movie theaters do you go when you design your expensive franchise sequel to be “bigger and more epic”? So, while Moana 2 sailed back to multiplexes amidst an industry-wide correction away from pyrrhic victories in streaming, its journey looks especially inevitable if you account for the particular industrial apparatus from which the film came.

We’ll expand on these ideas by teasing out a few historical threads relevant to Moana 2’s production. These concern Disney+, Disney Animation Studios, and the Walt Disney Company, as well as the latter’s general playbook toward franchising animated entertainment.

Disney+ and the business of animation today

Disney’s recent theatrical rebound is notable given the obstacles—some of them industry-wide, others self-inflicted—its film division has faced since its peak in 2019. That year, Walt Disney Studios reported $11.1 billion in worldwide theatrical revenue, with a record seven films (among them the animated sequels Toy Story 4 and Frozen II) each surpassing $1 billion at the global box office. In November of 2019, the company launched its Disney+ streaming platform. While it always seemed destined to succeed, Disney+ exploded in growth months later as the COVID pandemic closed theaters and Disney’s theme parks.

Since that high-water mark, Disney’s films have struggled, partially due to counterproductive distribution decisions and a streaming-focused production pipeline. On the distribution side, during the pandemic then-CEO Bob Chapek (above) launched Disney+’s day-and-date “Premier Access” program and arranged for Pixar’s latest films, beginning with Soul (2020), to skip theaters and instead premiere on the streaming platform. While this strategy fueled subscriber growth, almost every animated film Disney released to theaters in its wake, most notably Lightyear (2022) and Strange World (2022), underperformed at the box office. Analysts have attributed this cold streak to a range of causes, including the notion that Disney’s streaming release strategy had “conditioned audiences” to wait for theatrical releases to hit streaming.

Much ink has already been spilled on another contributing pop psychology phenomenon, that of “franchise fatigue.” The idea that audiences are burned out by the proliferation and interconnectedness of so much franchise material may not be neatly supported by the data. The top 10 movies of 2024 were all franchise properties, after all. It is a more credible notion if one examines Disney’s many spin-offs on streaming. Since 2019, the company’s marquee film production companies, among them LucasFilm and Marvel Studios, have shifted resources to producing long-form television series for Disney+. LucasFilm and Marvel respectively launched their Disney+ slates with The Mandalorian and WandaVision, both of which were well received and highly rated. But ever since, Disney’s streaming series have attracted increasingly mixed critical responses (even after controlling for toxic fan reactions) and diminishing viewership numbers (here and here).

That does not mean all Disney+ originals are destined for failure. What seems increasingly clear is that certain forms of programming, such as animation, perform more consistently, albeit under a typically lower ceiling of viewership. In October, The Hollywood Reporter published a 3000+ word article headlined, “Is Disney Bad at Star Wars? An Analysis.” To be clear, the piece answers its core question with, “On balance, no.” Nevertheless, this article is relevant to this discussion in that it contrasts the strong ratings of the Star Wars animated series on Disney+ with the franchise’s live-action series for the same platform. New animated series like The Bad Batch have more than earned their keep, with their large volume of episodes (usually 16 per season vs. 8 for live-action series) driving viewer engagement at a fraction of the cost of their recent live-action counterparts.

So, Disney+ is a sensible launching pad for new animated Star Wars series. Does that make it also wise to premiere the latest Disney Princess tale on the same platform? (Despite Moana 2’s “Still not a princess!” joke, in the eyes of Disney, she officially is one, as the Princesses scene in Ralph Breaks the Internet, below, demonstrates.) Well, that depends.

Traditionally, Disney has had three main paths for exploiting animated franchise content: theatrical distribution, commercial television, and direct-to-video (DTV). Each of these had clear advantages and disadvantages, and for many years these three paths looked fairly straightforward. Theatrical distribution, both then and now, is prestigious and visible to a large, diverse audience, and it comes with the potential for massive global box office revenues and merchandising opportunities which can immediately counteract the large budget.

The other two categories—commercial television and DTV—were lucrative paths for many years at the Walt Disney Company, but under the Disney+ paradigm have begun to appear less distinct from the theatrical option. Commercial television traditionally came with less expectation that it feel cinematic, and therefore could be made on a smaller budget. Television series promise a smaller, more concentrated audience of children or existing fans and a long tail financial model that relies on revenue generated through ad support and future syndication possibilities. DTV content, for its part, follows a similar model to commercial television but at an even lower scale of cost, with accordingly lower (but faster) profit potential.

The visibility of commercial television content within the Disney animated fold is moderate (and outright low for DTV). Millions of children apparently watched the Tangled (2010) spin-off Rapunzel’s Tangled Adventures, which was produced by Disney Television Animation and aired from 2017 to 2020 on the Disney Channel. We don’t expect you, reader, to have heard of this show, though at the same time we would be surprised if you never before heard of Tangled. Thus, even resounding successes of this type will remain off the radar of the general, adult-aged public, and so commercial television spin-offs, even if not the highest quality, will not inherently hurt the brand as a large film can.

It’s on this last point, regarding visibility, where the project formerly known as Moana: The Series was always destined to be different. With the company’s flagship studio, Disney Animation Studios, producing it, the budget leaped beyond any animated project Disney produced before for television or DTV. Launching Moana: The Series exclusively on Disney+ had potential upside, but as we will see, these benefits began to look questionable.

Moana’s voyage toward streaming…

Moana: The Series was first announced, by Jennifer Lee, at the virtual Disney Investor Day event in December 2020. The broader theme of the investor’s day was Disney’s new structure, which separated content creation from distribution in a bid to turn to what newly appointed CEO Bob Chapek referred to as a “DTC [direct-to-consumer] first business model.” The Moana series thus joined a slate of other Disney+ releases, including day-and-date release movies like Raya and the Last Dragon (2021), Marvel series such as Loki (2021-2023), and limited series such as WandaVision (2021). Though executives continued to gesture towards the importance of “legacy distribution platforms,” such as theatrical and linear television, the focus was on the corporation’s investment in Disney+. As Chapek put it in his opening statement:

We knew this one-of-a-kind service featuring content only Disney can create would resonate with consumers and stand out in the marketplace and needless to say Disney+ has exceeded our wildest expectations.

The idea to expand the Moana franchise into a series, therefore, was a direct result of corporate confidence in DTC platforms as the future of distribution. Chapek’s new corporate structure promised a streamlined production pipeline that seemed to completely separate the creation and production process from the distribution process — in other words, creatives would generate content and then the distribution team would figure out the best way to get that content to the consumer. Chapek explained the structure in a statement:

Managing content creation distinct from distribution will allow us to be more effective and nimble in making the content consumers want most, delivered in the way they prefer to consume it. Our creative teams will concentrate on what they do best—making world-class, franchise-based content—while our newly centralized global distribution team will focus on delivering and monetizing that content in the most optimal way across all platforms, including Disney+, Hulu, ESPN+ and the coming Star international streaming service.

This new agnostic approach to distribution seemed to lead to a general confusion about how to staff DTC productions. The Moana follow-up presented a mixed bag in terms of who was brought back from the original production. Voice talent Dayne Johnson and Auliʻi Cravalho respectively reprised their roles as Maui and Moana. However, original Moana directors Ron Clements and John Musker were absent. Instead, Jason Hand, Dana Ledoux Miller and David G. Derrick Jr. (above) were hired to co-direct and run the series. Hand, who had the most experience working with Disney animation of the three, started his career at Disney in 2005, as a layout artist on the DTV sequels Tarzan 2: The Legend Begins and Lilo & Stitch 2: Stitch Has a Glitch. Disney has a well-known apprenticeship program and tends to hire and promote from within, so it’s not out of the ordinary that a series like this would be given to greener talent looking to gain experience.

That said, Moana: The Series’s production team was indicative of a broader ambivalence the company seemed to have about how much to invest in, and therefore how to staff, DTC content. While the series Baymax! (2022) brought in Big Hero 6 (2014) director Don Hall as showrunner, other series like Zootopia+ (2022) and the upcoming Tiana (2025) did not bring back the same directing or writing teams from the original films. Instead, Zootopia+ was directed by Trent Correy and Josie Trinidad, who previously worked in the Animation and Story departments on Zootopia, respectively. Tiana is reportedly being run by Joyce Sherri, who served as staff writer for the Netflix miniseries Midnight Mass (2021).

…and back to the multiplex

News on the Moana series remained sparse from 2020 until February 2024, when Bob Iger announced during a CNBC interview that the series would now be a theatrical feature slated for a fall 2024 release. The news came shortly before a Q1 earning call where he assured shareholders that “the stage is now set for significant growth and success, including ample opportunity to increase shareholder returns as our earnings and free cash flow continue to grow.”

Iger’s assurance came on the heels of a tumultuous few years for Disney, after a series of box-office failures and an internal struggle for power that resulted in the ousting of CEO Bob Chapek and a return to the post for Iger. While the issues faced by Disney were multifaceted, the all-in approach to DTC content was central to the company’s financial struggles. Subscriber fees could only generate so much revenue, and that revenue didn’t seem enough to sustain the enormous content library required to maintain a streaming platform. In September of 2022, Bob Chapek indicated to Hollywood Reporter that Disney+ had a content problem. As Chapek put it:

It’s important to go back to when Disney+ was launched and what the hypothesis was about how much food you had to give that system for it to truly maximize its potential, and I would say we dramatically underestimated the hungry beast and how much content it needed to be fed.

The extent of this issue became apparent during a 2023 lawsuit against Disney by investors alleging Disney hid the actual costs of running the service to offer the appearance of profit potential. Though the service is reportedly now profitable, since its inception Disney+ has racked up over 11 billion dollars in losses, showing that the DTC, subscription-based model has not been the massive success it was predicted to be in 2020.

In late 2024, as the premiere for the re-titled Moana 2 approached, those who worked on it related to press outlets various versions of how the series abruptly shifted to a theatrical film. We can return to that September Entertainment Weekly profile to see a few explanations side-by-side. For instance, co-director David G. Derrick Jr. described the decision to pivot from a series to a feature film as a moment of “mutual realization” between the studio’s various teams:

It became apparent very early on that this wanted to be on the big screen. It felt like a groundswell within the whole studio.

Co-director Dana Ledoux Miller framed it as a push from the creatives, out of a desire to showcase their work. She suggested the project had “the best artists in the world” and added:

Why are we not letting them shine on the biggest screen in the biggest way?

This rhetoric stood in sharp contrast to Chapek’s 2020 Investor Day video, in which he seemed to downplay the importance of theatrical distribution in favor of the convenience of DTC exhibition. At that point, there was no sense that artists would feel minimized by having their work showcased on DTC platforms. Instead, these new comments by the creative team touted theatrical exhibition as a prestigious honor and the only way to showcase quality artistic achievement.

In other words, after years of the studio relegating several projects to Disney+ or day-and-date releases, Moana 2’s pivot feels like a pointed reinvestment in the theatrical experience. Jennifer Lee reinforced this perspective when she said to Entertainment Weekly:

Supporting the theaters is something that we talked about. … We love Disney+, but it will go there eventually. You could really put it anywhere, but these artists create stories that they want to see on the big screen and that we want the world to see on the big screen.

When the show was reworked as a movie, the absence of certain high-profile talent associated with the first Moana—especially popular songwriter Lin-Manual Miranda—became apparent. The official reason for Miranda’s absence was that he was already committed to another Disney theatrical project, Mufasa: The Lion King (2024). While Moana composers Mark Mancina and Opetaia Foa’i did return to score the movie, the new songs for the sequel were primarily composed by Abigail Barlow and Emily Bear. The two were, as Billboard put it, “the youngest (and only all-women) songwriting duo to create a full soundtrack for a Disney animated film.” Until that point their only real credit was writing an unsanctioned viral musical based on the Netflix show Bridgerton (2020 – ). Though having young women write the music for a musical about young women was a positive move for Disney, the pair’s relative inexperience became more conspicuous when the Disney+ show was transformed into a tentpole feature film. In its review of the film, The Hollywood Reporter noted that “Miranda’s absence is unfortunately felt” throughout the musical numbers. Variety, more pointedly, called the new batch of songs, “imitation-Lin-Manual knockoffs.”

The lack of personnel continuity between Moana and Moana 2 highlights the general disorganization within Disney’s new corporate structure. Despite the claim that content can be created and then distributed wherever by reading the will of the data gods, the reality is projects still seem to work best when the venue of the exhibition is known during the early stages of production. When Disney has done theatrical sequels they tend to staff them with creative talent from the original. Jennifer Lee oversaw the creation of Frozen 2 (2019), Andrew Stanton returned for Finding Dory (2016), and Pete Doctor directed Inside Out 2 (2024). Though Miranda claims he was otherwise preoccupied, one wonders if he would have still worked on Mufasa: The Lion King had he known the Moana follow-up was destined for a theatrical release.

While this is primarily an industry analysis, even a cursory look at Moana 2’s narrative reveals the editorial marks left by this unusual production. As with the first film, the sequel tasks Moana with breaking an ancient curse, except this one was set by a storm god named Nalo, who drove the different peoples of Polynesia apart. With this clear objective, Moana remains a classical, goal-oriented protagonist, but the seams begin to show once you look at the other characters. Curiously, Nalo remains an off-screen antagonist, who is not properly introduced until a mid-credits scene that mimics Thanos’s first appearance in The Avengers (2011). The journey is also now populated by a group of secondary characters easily identified by a defining trait (e.g., Moni is a huge Maui fanboy). The first act, set on Moana’s well-populated island of Motunui, feels especially abridged from the project’s looser, episodic origins, and the onslaught of new characters leaves little room for the emotional depth and character development that many critics respect about the first film (here and here).

The seams where Moana: The Series was stitched together into Moana 2 are not only evident in the story, but in the production and promotion as well. Being forced into the throes of a giant A-list press junket was probably not what these first time directors signed up for; it’s certainly something the team behind the direct-to-video Cinderella II: Dreams Come True (2002) never had to deal with, and for good reason.

Yet Moana 2’s directors were left answering questions about decisions made in the first movie they had little or no control over. For example, the cute pig Pua, whom fans felt was underused in the original movie, took on a more prominent role in the sequel. When asked by CinemaBlend if they responded to any feedback about the first film, director/writer Dana Ledoux Miller responded:

Look, people really wanted Pua in that first movie on the canoe. I wasn’t around, but we put Pua on the canoe now.

While not overly awkward, the exchange highlights the behind-the-scenes break in continuity. Similarly, young songwriters who should be establishing their own identity were instead having their work compared to the beloved music of Lin-Manuel Miranda. Ultimately, while this has financially paid off for Disney, Moana 2 was clearly a ship built for the smaller more secluded waters of Disney+. Though it has survived, the tepid reviews suggest it may have been only by the skin of its teeth.

Riding the popcorn-bucket wave

Moana 2 is not only indicative of the pitfalls of the DTC model but highlights the inherent potential of theatrical distribution, especially for franchised content. Despite lukewarm reviews, the movie has already earned record numbers at the box office. More importantly, it has reignited interest in the brand more broadly. Moana became the latest entry in a list of high-profile collectors’ popcorn buckets distributed by theaters (above).

While they might seem like a gimmick, these popcorn buckets have become an integral aspect of the theatrical distribution model and the “post-pandemic ‘identification’ of moviegoing.” They  work in favor of both the theaters and the studios by raising awareness about the films and the brand. As one journalist pointed out, “I didn’t realize Despicable Me 4 was happening until I saw the popcorn bucket.” With the release of toy lines (Funko dolls aplenty, including Pua, above and left), popcorn buckets (and nacho boats!), and theme park tie-ins, the hype machine that spins around a massive theatrical release has become somewhat intuitive over the past century in a way that DTC models have difficulty emulating, even with the benefit of synergy within vertically integrated corporate structures. work in favor of both the theaters and the studios by raising awareness about the films and the brand. As one journalist pointed out, “I didn’t realize Despicable Me 4 was happening until I saw the popcorn bucket.” With the release of toy lines (Funko dolls aplenty, including Pua, above and left), popcorn buckets (and nacho boats!), and theme park tie-ins, the hype machine that spins around a massive theatrical release has become somewhat intuitive over the past century in a way that DTC models have difficulty emulating, even with the benefit of synergy within vertically integrated corporate structures.