Archive for the 'Film industry' Category

“Indie blockbuster franchise” is not an oxymoron

Kristin here:

The Cannes Film Festival continues even as I type. Much of the wheeling and dealing at the market that accompanies the festival is being driven by two franchises that few people outside the film industry think of as independent films: the Twilight and Hunger Games series. Indie blockbuster franchises aren’t common. In fact, there had previously been only one, but its parallels to these contemporary franchises reflect a recent major shift in international independent distribution.

True or false, The Lord of the Rings is an indie film

In May of 2001, I, as a Tolkien fan since high school, was resolutely ignoring the production of a film adaptation of The Lord of the Rings, going on in New Zealand. The first part of the trilogy was to be released in December, and there was widespread skepticism in the press, both popular and trade, and among fans and industry insiders concerning the possibility of the film’s being a success. Another fantasy adaptation, Harry Potter and the Sorcerer’s Stone, looked likely to be the hit of the Christmas season, eclipsing New Line Cinema’s expensive gamble.

Then came New Line’s Cannes event of 2001. Over a three-day weekend, the studio presented an elaborate program to reveal the film. On Friday night there was a screening of a 26-minute preview of footage from all three films, with an extended portion of the Mines of Moria scene in nearly completed form as its centerpiece. Even cast and crew members present, as well as top New Line officials, had not yet seen any of the film’s finished footage until that screening, and they were overwhelmed. Jaded reporters cheered and asked to have the preview re-run. Extra screenings had to be arranged. A series of press interviews were held, and a lavish party complete with sets and props from the film was held in a chateau. Suddenly the popular press was full of infotainment pieces predicting that the trilogy would be a blockbuster hit. Fan webmasters invited to the event posted enthusiastic, even ecstatic reports.

Variety’s report of the preview screening is the first article about the film that I remember reading. It began:

It’s hard to imagine a more relieved group of distribs gathered into one place than the collection who’d just finished watching a 26-minute film from New Zealand that cost $270 million.

The enthusiastic response from distribs, exhibs and worldwide press to the screening of footage from New Line’s “Lord of the Rings” at Cannes Olympia theater means that foreign companies that bet the farm on the three-year franchise now have cause for confidence they’ll recoup their investment–with coin to spare. […]

In marketing meetings after the screenings, NL execs told distribs that the target is for all of them to outdo the previous top grosser in their territory. In some countries, that’s going to mean spending as much again on P&A [prints and advertising] as they did to buy the films in the first place, but at least now that seems more like an opportunity than a terrifying risk.

Rolf Mittweg, at the time head of New Line’s international marketing and distribution, noted: “My Japanese distributor said he had a knot in his stomach for the whole year, and now it has dissolved.” [Adam Dawtrey, “Will ‘Lord’ ring New Line’s bell?” 21-27 May 2001, pp. 1, 66.]

This considerably intrigued me, and it was probably the first step in the long path that ended with me writing The Frodo Franchise: The Lord of the Rings and Modern Hollywood.

What Variety was referring to, it turned out, was the twenty-six independent distributors from various territories around the world who were forced by New Line, if they wanted LOTR, to pay large sums up front for the film, sight unseen. That in itself wasn’t odd, since independent films were commonly financed in part by pre-sales to international distributors, often on the basis of a script or a star attached to the project. The difference here was that the chosen twenty-six had to pay a lot (as much as $8 million for the larger European territories) for all three feature-length parts of the film. If the first one flopped, the second and third would be almost worthless. Small wonder they were nervous going into the Cannes event.

As everyone knows, LOTR went on to enormous success, with the third installment becoming only the second film to cross a billion dollars in worldwide grosses (the first having been Titanic in 1997).

Many people would be surprised to learn, however, that LOTR was not the product of one of the major Hollywood studios. It came from an independent company, New Line. True, New Line was at that point owned by Time Warner, but it operated as an independent film producer-distributor. That is, it didn’t receive financing for its films from its parent company but through pre-sales–pretty much the definition of an indie establishment. It was also a studio that thrived in part because it stressed franchises, notably the Nightmare on Elm Street, Teenage Mutant Ninja Turtles, Rush Hour, and Austin Powers films. Successful though these were, LOTR was a step up for New Line, both in terms of prestige and budget. It was perhaps the first indie blockbuster franchise.

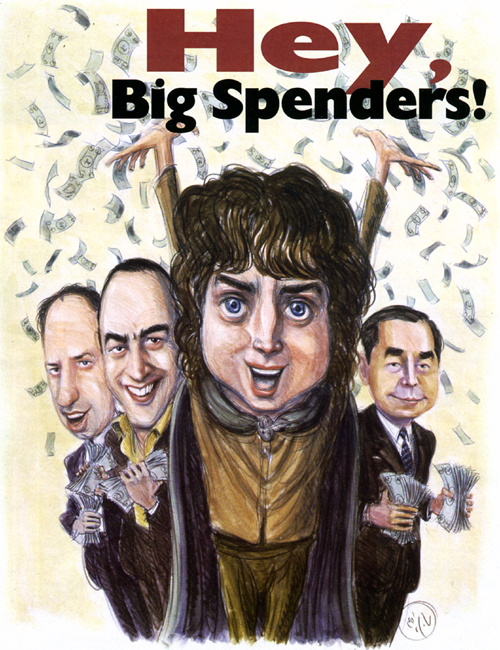

It was such a blockbuster, in fact, that LOTR helped pull the international independent and foreign-language film market out of a major slump that had begun in mid-2000 in the wake of over-production in the late 1990s. The crises in the Brazilian and Argentinian economies in 1999, the bursting of the dotcom bubble in mid-2000, and the 9/11 attacks in 2001 worsened the decline. I won’t go into detail here. (You can read a more thorough account in Chapter 9 of my book.) Suffice to say that the crisis happened to be at its worst when The Fellowship of the Ring came out in mid-December, 2001. During the first half of 2002, there were slight signs of a recovery, but the accumulating income from the film and also from the summer release of the DVD strengthened it considerably. By the time of the American Film Market in early 2003, The Hollywood Reporter ran the caricature above and declared, “With his quest to save Middle-earth from the Dark Lord, the intrepid hobbit might have helped rescue the annual event from the clutches of a global recession.”

As a result, the lucky 26 distributors were able to buy more at the AFM and other important indie sales venues. Reporting from Cannes, Variety declared, “The global bonanzas of ‘Lord of the Rings’ is playing its part in driving big-budget pre-sales.” Screen International said New Line was “buoying the indie market with The Lord of the Rings.” Sales and pre-sales of indie films were up. Small companies could afford to buy more desirable films than in the past. For example, SF Film in Denmark (a branch of Sweden’s AB Svenska Filmindustri) was able to acquire Million-Dollar Baby, a film that previously would have been beyond its means. A few of these companies also used their LOTR money to produce local films or to open art-house cinemas.

The problem was, the film had only three parts. New Line’s next attempt at a blockbuster franchise would knock the biggest supplier of indie films to foreign distributors entirely out of the market.

The New Line void

On December 7, 2007, The Golden Compass was released, the first in an intended trilogy based on the “His Dark Materials,” a trio of prize-winning books by another English author, Philip Pullman. With a reported production budget of $180 million, the film grossed about $70 domestically, though it managed $372 million worldwide.

On March 28, 2008, four years and four weeks after The Return of the King won eleven Oscars, Time Warner announced that New Line would be absorbed into Warner Bros. Entertainment as a genre unit. Its domestic distribution and international sales activities would be dissolved. The top executives of the international sales wing, Rolf Mittweg and Camela Galano, who had helped put together the enormously complex group of foreign distributors who largely financed LOTR, would soon be out of jobs. The fact that the change came less than two months before the Cannes Film Festival led trade papers to assess New Line’s importance as a supplier to the international independent market and to speculate on what companies might step into the void left by its departure.

(For my own analysis of what the loss of New Line product would mean for the indie market, see “Filling the New Line gap,” from November 6, 2008.)

Shortly after the March announcement, Screen International editor Mike Goodridge looked back at the impact of Peter Jackson’s trilogy on the distributors who released it abroad:

The success of the three films for the international partners cannot be overestimated. Nor can the fact they, more than anybody involved, took a huge risk on the trilogy. The risk paid off. The Greens at Entertainment [UK distributor], the Hadidas at Metropolitan [French distributor] and others genuinely shared in the profits of one of the box-office phenomenons of of the last 20 years. It was the international buyers’ dream. Instead of losing money on studio cast-offs, they had a hefty piece of a trilogy which grossed nearly $2bn outside North America. [“The End of the Line,” 7 March 2008, p. 6.]

Goodridge points out that although The Golden Compass, New Line’s intended first entry in the “His Dark Materials” trilogy, had not done well in North America, its box-office abroad was likely to hit in the region of $300 and speculated that if it did, “Warner Bros. will be hard-pressed to deny production to a sequel.” [p. 8]

This optimistic view generously assumes that Warners would want to reward New Line’s old customers abroad by making the two remaining films in the trilogy despite a possible repeat of the first installment’s lackluster domestic gross. Instead, Jeff Bewkes had no interest in keeping up alliances with those loyal distributors, since by investing in the production of films up front, those distributors got to keep most of the box-office takings in their respective countries. As Bewkes said, “With the growing importance of international revenues, it makes sense for New Line to retain its international film rights and to exploit them through Warner Bros.’ global distribution infrastructure.” (For more on the international implications of the absorption of New Line, see this piece on my Frodo Franchise blog.)

Goodridge quotes San Fu Maltha, head of Dutch distributor A-Film (which had the LOTR trilogy for the Netherlands): “New Line was one of the supplier of major films. For [the distributors,] it was, if not a lifeline, an important source.” New Line films from 2007 that had done well abroad included Hairspray, Rush Hour 3, and The Golden Compass. Earlier hits had been entries in the franchises that had traditionally driven New Line’s success: the Austin Powers series, the Nightmare on Elm Street series, and so on. Goodridge concluded that Summit and Overture would be major sources of quality films for the foreign market.

In early May, 2008, with Cannes looming, Variety ran a story about the opportunities opened by New Line’s departure from the market. The subtitle suggests how big the change was perceived to be: “Opportunities Rock: Fresh contenders eager to join international indie scene’s new world order.” The story speculated on the various independent sales groups that will be at Cannes and which ones might be strong enough to replace New Line: QED, with W, District 9, and A Perfect Getaway; Essential Entertainment, with My One and Only; The Film Department’s Law Abiding Citizen and The Rebound.

Swart also noted changes in two major suppliers to the indie market. Summit was growing, having opened its own domestic distribution wing. It “is chasing studio ambitions, which seems to have taken the main emphasis off foreign sales.” Mandate (notable for Juno and the Harold and Kumar sequels) had been acquired by Lionsgate in September, 2007.

Cannes also provided the occasion for a second in-depth analysis of the New Line void by Screen International. Author John Hazelton suggested that New Line’s regular supply of six to eight films to its regular distributors overseas benefited international indies as a whole:

Many sales executives, in fact, go further and suggest that by boosting the fortunes of the distributor partners with which it had ongoing output or package deals—companies including the UK’s Entertainment, France’s Metropolitan, Australia’s Village Roadshow and Spain’s Tri Pictures—New Line effectively elevated the independent international industry as a whole. Other sellers benefited, for example, when the New Line distributors reinvested profits from The Lord Of The Rings and Rush Hour movies—or from last Christmas’ The Golden Compass—in the acquisition of non-New Line films.

Hazelton quotes Steve Bickel, president of The Film Department’s international wing: “New Line provided a great service to all of us because they helped make strong companies that we’re now able to sell to.” The author also presciently singles out Summit and the newly merged Lionsgate and Mandate as “leading the field of remaining big picture suppliers,” noting that both companies had recently expanded into domestic distribution and were signing output deals in some foreign countries.

The article refers to The Weinstein Company and The Film Department as promising new players. Relativity, having produced Atonement, Evan Almighty, Baby Mama and Pineapple Express, was moving for the first time into international sales at Cannes. Other companies are mentioned as possibilities. Hazelton concludes:

On its own, Relativity probably will not fill the gap created by the disappearance of New Line from the business that A Nightmare On Elm Street, The Mask and The Lord of the Rings helped build. And neither will any of the other sales companies or producers now eyeing the fresh demand for upscale product from international buyers. But between them, the new entrants, growing boutiques and established players will be trying fill the New Line-shaped void appearing on the international sales landscape.

Reporting that autumn on the American Film Market, Screen International noted that The Weinstein Company had sold five films to Entertainment, formerly supplied by New Line. These included The Reader, Zack And Miri Make a Porno, and Piranha 3-D. Relativity had closed multi-year output deals with several overseas distributors, including former New Line customers Village Roadshow (Australia, New Zealand, and Greece) and Alliance Films (Canada). Neither company, however, would be the one to release the second indie blockbuster franchise.

From New Line to New Moon

In 2008, the world was in a global recession brought on by the financial crisis of 2007. But even as the trade press was speculating on which company or companies would replace New Line, help was on the way. Summit’s release of Twilight came in November of the same year, and although it did not make as much as the three following films in the franchise so far released, it grossed nearly $393 million internationally, $200 million of that outside North America. A healthy take for a film reportedly budgeted at $37 million.

The modest title did not indicate that Twilight was the launch of a franchise, though obviously Summit was hoping that it would be. The subsequent entries were more forthright and more lucrative: The Twilight Saga: New Moon (November, 2009, nearly $710 million worldwide), The Twilight Saga: Eclipse (June, 2010, about $700 million), and The Twilight Saga: Breaking Dawn Part 1 (November, 2011, just over $705 million), with the final installment due out in November of this year.

On the occasion of the second film’s release, Mike Goodridge of Screen International noted that the franchise’s success echoed that of a certain earlier series:

Distributed in major territories by companies which had signed to output deals with Summit Entertainment for its in-house productions, the first film, Twilight, was a sensation buyers were hardly anticipating when they made the initial deals. [….] Seeing E1 Films take nearly $20m in the UK, SND in France scoring $17m, Eagle in Italy $14.3m and Aurum in Spain $13.7m last weekend brought back the heady days of The Lord of the Rings openings.

Goodridge also pointed out:

What The Lord of the Rings proved and the Twilight Saga reaffirms is that this kind of independent success is good for everybody. The Twilight distributors will have more money to invest in financing and acquisitions, benefiting other independent productions, while sales companies struggling to get films off the ground in a turgid distribution world will hopefully encounter a renewed buoyancy in the international markets.

He concluded, “For independents, the loss of New Line wasn’t as damaging as first imagined.” [“New Moon’s new line of success,” ScreenDaily.com, 26 November 2009.] It should be pointed out, though, that the gap between the third LOTR film and the first Twilight one was six years.

The Lionsgate share

On January 13, 2012, Lionsgate finalized its deal to buy Summit, thus acquiring the Twilight series. On March 23, Lionsgate released The Hunger Games, with an opening weekend of over $152 million domestically and a worldwide gross of $637 million after 9 weeks in release. Within less than three months, the company came to control the two largest indie franchises since LOTR. In late March, a financial analysis of Lionsgate by The Hollywood Reporter remarked, “The rest of the Hunger Games movies will now bring in significantly higher returns.” [Alex Ben Block, “How ‘Hunger Games’ Box Office Haul Impacts Lionsgate’s Bottom Line,” The Hollywood Reporter, 3 March 2012.] The reference was to the sales of foreign distribution rights, not higher box-office grosses.

Given how recent these events are, it happens that only two international distributors control both the Twilight series and The Hunger Games for their respective territories: Paris Filmes, of Brazil, and Nordisk Films, Denmark. Peter Philipsen, general manager for independent films at the latter told Variety that such series are rare: “There are not a lot of franchises in this business that really work, let along in the independent market,” Philipsen notes. “The last one before ‘Twilight’ was ‘Lord of the Rings,’ which was huge and gave a really big boost to the business as a whole.” [Diana Lodderhose and Adam Dawtrey, “International buyers eye bigger pics,” Variety.com, 5 May 2012.]

If Twilight helped ease the pain of the global recession for many indie distributors worldwide, by Cannes, 2012, the accumulating impact of its franchise and the addition of The Hunger Games led to greater prosperity. Those films and other successful non-franchise movies (some presumably bought with money from the Twilight franchise) led foreign distributors at this year’s Cannes festival to look for bigger films. Diana Lodderhose and Adam Dawtrey reported in Variety:

Sales agents brought a number of well-received big-budget projects to market last year, notably “Cloud Atlas,” “Pompeii” and “Enders Game.” But this year, with the indie sector stronger theatrically than it has been in years, and with international distributors flush with success from pics like the “Twilight” franchise and “The Hunger Games,” as well as “The Iron Lady,” “The Woman in Black,” “The Artist” and “Midnight in Paris” all having performed well territorially, there’s a feeling among buyers that bigger is better.”

A large number of new indie companies have emerged, many of them started by executives formerly at Summit, Lionsgate, and New Line. Among those represented at Cannes for the first time this year is Speranz13 Media, headed by Camela Galano, mentioned above as having helped arrange pre-sales for LOTR at New Line. Variety commented:

Pre-Cannes, a raft of new sales outfits headed by esteemed execs […], coupled with more money in the pockets of indie distribs who had successful runs with such pics as the latest “Twilight” installment, “The Hunger Games” and “The Intouchables,” suggested that this would be a market with greater liquidity.

And it has been.

“Many indie buyers have money now and they know what they want, which is studio-level movies,” said Foresight’s Tama Stuparich de la Barra, whose projects “Lone Survivor” and “Motor City” sold out at the market. [Diana Lodderhose and Dave McNary, “Cannes market totes up solid business,” 21 May, 2012.]

One notable aspect of all this is a return to pre-sales for financing big independent films. A few years ago, pre-sales were declared dead, partly because distributors couldn’t afford to invest in unmade projects. Lionsgate, however, financed about 60% of The Hunger Games through the sales of individual foreign sales rights. Production rebates from North Carolina kept the film’s budget at a relatively modest $80 million, limiting the studio’s risk on the film. These strategies are similar to what New Line tried while making LOTR.

I have yet to see coverage of Cannes that explicitly dubs Lionsgate the successor to New Line, the new indie “mini-major” that will supply a steady stream of films to foreign distributors with which it has output deals. Still, the conclusion seems all but made. At Cannes it began pre-sales for Catching Fire, the sequel to The Hunger Games. On May 23 it announced a long-term renewal of its partnership with the powerful French producer-distributor StudioCanal, including a deal for StudioCanal to distribute Catching Fire in German-speaking regions. Under this partnership Lionsgate has certain distribution rights to StudioCanal’s huge library of film and television titles, the third largest in the world, including titles ranging from Grand Illusion and The Discreet Charm of the Bourgeoisie to Terminator 2 and The Deer Hunter. [Dave McNary, “Lionsgate, Studiocanal extend pact,” Variety.com, 23 May 2012] On May 24, Screen International summed how various sales for various companies at Cannes were going:

Patrick Wachsberger and Helen Lee Kim reported a roaring trade on the Lionsgage slate, especially the Dirty Dancing remake. “It has been a strong market for us and the team has been seamless,” Wachsberger said of the post-merger infrastructure. [Jeremy Kay, “Market buoyed by sellouts,” 24 May 2012, p. 1.]

No doubt at some point Lionsgate will face a financial crisis and lose its central status, but with two big indie franchises in progress, it seems settled for the foreseeable future and beyond.

Ironically, the blockbuster franchise that started it all will resume this year, but not in the indie sector. The two parts of The Hobbit, due to be released in December of this year and 2013 as prequels to LOTR, are being produced by New Line. They are not being financed by pre-sales to indie distributors around the world. Instead Warner Bros. is providing funding, and it will also distribute.

I have linked to stories when I could find them online, but some articles I quoted are either behind paywalls or simply not online. They are taken from issues of the trade papers mentioned in the text.

The illustration at the top of the entry topped an article called “Hey, Big Spenders,” cited above. It appeared in The Hollywood Reporter (February 2003), pp. 1, 4, 8, 12. The piece dealt with the American Film Market, which at that time still happened in the spring. Naturally the caricature of Frodo tossing money around caught my eye. (The distributors flush with LOTR cash are, left to right, Joel Pearlman of Roadshow Films, Australia (?); Trevor Green of Entertainment Film Distributors, UK; and Hiromitsu Kurukawa, Nippon Herald Pictures, Japan.) This was one of the few articles I found in the trade press that dealt with the considerable impact that LOTR had on the international indie and foreign-language film market. I used the caricature as an illustration in Chapter 9 of my book. After all, how do you illustrate the concept of a film helping pull the indie business out of a global slump? That picture was ready-made for such a topic. I contacted the artist, Victor Juhasz, for permission to reprint the image, which he kindly gave. It occurred to me that he would be the ideal person to provide an image for the cover of the book as well. Again, how do you illustrate the general concept of a franchise based on The Lord of the Rings? Have a character surrounded by licensed products based on that character, I figured. Fortunately the University of California Press agreed. Based on photos, an action figure, a polystone collectible bust, and a video-game strategy book that I sent him, Victor produced exactly what I had in mind. A small image of that cover illustration appears up at the right, beside the Hollywood Reporter caricature.

PANDORA’s digital book

DB here:

Looking back at Kristin’s and my ventures online, I see a gradually expanding series of experiments. Step by step, maybe too cautiously, we’ve moved toward what you might call “para-academic” film writing–a way of getting ideas, information, and opinions out to a film-enthusiast readership whom we hadn’t reached with our earlier work. (Although we’re happy when academics take note of what we do.)

Today we have a new experiment to try. Pandora’s Digital Box: Films, Files, and the Future of Movies is now available here. Backstory follows.

Baby steps, then longer ones

To take another metaphor, we’ve been gradually exploring various niches in the online ecosystem. At first, back in 2000, knowing almost nothing about cyberculture, I dumped my vitae and a little essay onto my brand-new Geocities site. Later I saw the site mainly as a supplement to print publication, a way to add and correct things I’d written in my books Figures Traced in Light (2004) and The Way Hollywood Tells It (2005), along with material we’d included in our textbooks Film Art and Film History. By then I had retired from teaching.

I started to write more online. I began posting long, stand-alone pieces that I couldn’t imagine any journal or anthology publishing. (They’re in the list on the left-hand column of this page.) Somewhere around 2007, after finishing the collection Poetics of Cinema, I made Web publishing my primary expressive vehicle. So when I was asked to write pieces for various occasions, I tried to secure permission to publish them here as well. They too have wound up in the line-up on the left– a little essay on Paolo Gioli, one on Shaw Brothers’ widescreen cinema, and a liner note about The Mad Detective for the Masters of Cinema DVD line. There are more to come in this vein, including a historical survey of how film theorists have drawn ideas from psychological research.

While moving to fill the essayistic niche, we saw archival and revival opportunities as well. Thanks to Markus Nornes, I was able to republish the out-of-print Ozu and the Poetics of Cinema in a downloadable pdf version, with color illustrations. That’s on the University of Michigan Press site. Vito Adiraensens, who made a pdf of Kristin’s Exporting Entertainment, allowed us to post that on our site.

At this point, whole books we’ve done were available online. But those were straight reprints. The next logical step was to offer a revised edition. After the rights to Planet Hong Kong (2000) reverted to me, I decided to update and expand it and add color illustrations. I also decided to ask for money, making PHK 2.0 the only item on the site that wasn’t free. That was an experiment too, to see if the year I spent reshaping it might yield some payback. It did; so far, the sales have covered the costs of design and yielded me a little for my efforts.

Meanwhile we’ve explored the blog niche. Started in 2006, refreshed once or twice a week, our blog has become greatly satisfying to us. This entry is number 499. We’ve treated the blog wing of the site as a sort of magazine, with each entry as a feature or column or festival report or book notes. We write about anything cinematic, old or new, that interests us. The freedom is exhilarating, and we don’t lack ideas. I have a desk drawer’s worth of folders on topics I want to explore.

Nearly all of these are long-form endeavors. Some run to 6000 words. Even our festival reports, which could have been emitted in a flurry of communiqués, are blended into spacious pieces that permit us to compare films or develop a common theme. At a time when everyone declares that attention spans have shrunk to pinpoints, readers have been very patient with us. People still visit our blog, recommend it to others, and even Facebook and Tweet about it. Roger Ebert has been an especially generous supporter. Thanks to the efforts of Rodney Powell of the University of Chicago Press, we gathered some of our entries into a book, a “real” one called Minding Movies, and I’d hope that the length and contextual depth of the pieces gave them some bookish solidity.

Another niche coming up: As virtual books have found a public, I’ve made a book designed primarily for an e-reader.

Not bloviation, blogiation

Last fall, after realizing the scope of the digital conversion of movie theatres, I decided to write a series of blogs about it. I had no fixed number in mind, but I didn’t expect it to run as long as it did. I kept learning more, so the series, called Pandora’s Digital Box, stretched from December through March. I was encouraged by people who praised it in blogs and on social media. I decided to try to build a book out of the pieces.

Some people think that this is silly. One reviewer of our blog book, Minding Movies, wondered why anyone would buy something that’s available for free. More alert reviewers, like Scott Foundas of Film Comment (May/June 2011), understood that some readers don’t like to read long-form prose online, or don’t like zigzagging through the labyrinth that is our site, or want some guidance in selecting what to pay attention to. Moreover, by gathering items topically, the book suggested recurring themes and an overall frame of reference governing what we do. The broad aims of our enterprise aren’t apparent in a daily skim of each entry.

Still, Minding Movies was a varied mixture. Pandora was from the start a more focused series. And we added no new essays for our collection, but I had quite a bit more to say about the digital conversion. So I cooked up new rules for my latest experiment.

1. The original entries wouldn’t be taken down. As with Minding Movies, the entries will remain available online.

2. The book wouldn’t be simply a blog sandwich. I’ve rewritten, rearranged, and merged entries for smoother reading. The topics are more logically ordered, and the whole thing hangs together organically. The blogs formed a kaleidoscope; the book is a narrative.

3. The book would have lots of new material. It includes things I didn’t know when I wrote the blog, ideas that have come to me since, and as much background and context as I could supply. The original blogs amounted to about 35,000 words (enough for a Kindle single). The finished book runs over 57,000 words.

4. It wouldn’t be an academic book. It’s written in the same conversational tenor as the blog. I try not to make anybody’s head hurt. No footnotes, but….

5. The book would exploit online access. The text is unsullied by links, to promote continuity of reading. But a section of references in the back contains citations and hyperlinks to documents, interviews, sources, and sites of interest. This section tells you where I got my information and, if that information is online, takes you there.

6. The book would have to be for sale… Part of this experiment is to see whether I can make back what I’ve spent on the project. I reckon that my travel to theatres and events like the Art House Convergence in Utah, along with other expenses like paying our Web tsarina Meg to polish up my self-designed Word book, comes to about $1200. In addition, I’d like something for my extra time and effort.

7. …but not cost too much. Planet Hong Kong 2.0 runs $15, which I think is a fair price given the cost of designing a book with hundreds of color pictures. But Pandora is a lot simpler and has only a few stills. So I’m offering it for much less: $3.99.

Another Whatsit, but only $3.99

Pandora’s Digital Box: Films, Files, and the Future of Movies traces how the digital conversion came about, how it affects different sorts of theatres, how it shapes the tasks of film archives, and what it portends for film culture, especially the culture of moviegoing.

A key concern was trying to go beyond what I’d already written. For one thing, I try to answer questions I didn’t pursue in the blog entries. How did the major distributors orchestrate the transition? How did they reconcile the interests of the various stakeholders—filmmakers, theatre owners, manufacturers? By 2005, the specifications for digital cinema were established, but the real uptake came five to six years later. What led to the delay? How was digital cinema deployed outside the US? And so on.

Second, I provide background and context for areas I surveyed quickly online. For example, instead of sketching how a movie file gets projected, I take you into a booth and we follow the process step by step. The chapter on small-town cinemas reviews the role of single-screen theatres in the industry. The chapter on art-house cinemas goes back to the 1920s and shows remarkable continuity of taste and business tactics up to the present. Throughout, I consider how the US exhibition system has worked since the rise of multiplexes.

Third, there are unexpected tidbits. How did celebrity directors like Lucas, Cameron, and Jackson spearhead the shift to digital and later innovations? (I touched on that in a couple of recent entries here and here, but there’s more in the book.) Who invented multiplexes? Cup holders? When did those annoying preshow displays start, and more important, who controls them? How do distributors decide whether to release a movie wide or to let it “platform”? Why do art-house theatres serve coffee? There are even a couple of jokes (maybe more unintentional ones).

I think it has worked out well. I’ve tested the text on Kindle, Nook, and the iPad, and it fits very snugly. You just have to import it as a pdf from your computer. On the iPad, it seems to work particularly well with the app GoodReader, which permits smooth searches, easy bookmarking, and quick shifts back and forth.

As I mentioned above, you can go here to order the book. On the same page you can examine the Table of Contents and a bit of the Introduction.

It’s possible that some people might want to make a bulk purchase. Pandora might be used in a class, or given to staff members working at a film festival, or presented to members or patrons of an art house. For such worthy purposes, I can make the bulk price quite low. If you’re interested, please write to me at the email address above.

Self-publication is a risk for both author and reader. If you decide to buy the book, I thank you.

The next logical steps? A new ecological niche? A completely original book online, maybe. Or PowerPoint lectures with voice-over. Who knows? As Jack Ryan says at the end of The Hunt for Red October: Welcome to the new world.

Thanks as usual to our Web tsarina Meg Hamel, who did her usual superb job turning Pandora the Blog into Pandora the Book, and who has set up the payment process to be quick and easy. Earlier helpmates were Vera Crowell and Jonathan Frome, whose efforts in creating this site are remembered and appreciated.

The illustrations are from Kiss Me Deadly and Pandora and the Flying Dutchman, but you knew that. Thanks to Jim Emerson for his suggestions.

A man and his Focus

James Schamus on State Street, hailed by local livestock.

DB here:

“I wish,” one of my students said during a James Schamus visit to Madison back in the 1990s, “I could just download his brain.” Probably many have shared that wish. James is an award-winning screenwriter who has become a successful producer and head of a studio division, Focus Features (currently celebrating its tenth anniversary). No one knows more about how the US film industry works than James does. Yet he’s also deeply versed in the history and aesthetics of cinema. He teaches in Columbia’s film program, and his courses involve not filmmaking but film theory and analysis. How many people who can greenlight a picture have written an in-depth book on Dreyer’s Gertrud?

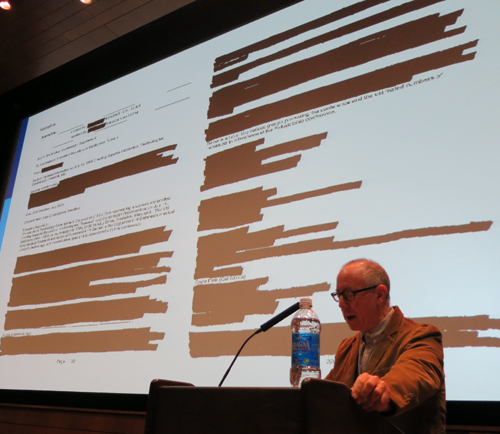

James came to campus last month for our Wisconsin Film Festival. His official event, sponsored by the University Center for the Humanities, was a talk called “My Wife Is a Terrorist: Lessons in Storytelling from the Department of Homeland Security.” That was quite an item in itself, tracing how James’ wife Nancy Kricorian discovered that she had a Homeland Security file. Pursuing that led him to broader meditations on digital surveillance in modern life. If he’s invited to present this in a venue near you, you’ll want to catch this provocative tutorial in how to read a redacted document.

While he was here, James spent a couple of hours in J. J. Murphy’s screenwriting seminar, and of course I had to be there. Herewith, some information and ideas from a sparkling session.

All battleships are gray in the dark

Hulk.

“This is not writing,” Schamus said. By that he meant that a screenplay isn’t parallel to a piece of creative writing, an autonomous work of art. Nobody ever walked out of a movie saying, “Bad film, but a great script.” In this he echoed Jean-Claude Carrière at the Screenwriting Research Network conference I visited back in September. A screenplay is “a description of the best film you can imagine.”

What sort of description? For certain directors, sparse indications are best. Collaborating with Ang Lee, Schamus knows he must under-write. Lee doesn’t want a movie that’s wholly on the page: “Ang wants to solve puzzles.” But for a studio project, the screenplay has to be airtight, since it functions as an insurance package for any director the producers hire. “A script has to be a battleship that no director can sink.”

James pointed out a bit of history. Back in the 1910s Thomas Ince rationalized studio production by using the script as the basis of all planning—budget, schedule, locations, and deployment of resources. The same happens today, with the Assistant Director breaking down the script for different phases and tasks of production. But on a studio project not everything is tidily planned in advance. Scripts can be rewritten during shooting or even later. Sometimes there are “parallel scripts”: stars can hire writers who spin out “production rewrites” to be thrust on the director. James, who has prepared the screenplay for Hulk and done his share of uncredited rewrites on other big films, speaks from experience.

Independent companies rely on screenplays too; Focus is writer-friendly. But in this zone of the industry, the writer needs to create a “community” around a script idea—a director or group of actors and craft people that support it. These are as valuable as a polished screenplay in getting a film funded.

What about the current conventions, like the three-act structure? James rejects the Syd Field formula. He thinks that the writer will spontaneously devise some intriguing incidents and arresting characters without recourse to beats, arcs, and plot points. “You can’t have half an hour go by without giving your characters something to do, or to shoot for.”

He also suggests that the writer’s second draft should be an exercise in rethinking the whole thing. “Don’t write your second draft from the first-draft file.” In your redraft, use flashbacks, play around with structure, or tell the action from a different point of view. This will engage you more deeply with the material and show you possibilities you hadn’t imagined. In terms I’ve floated in various places: take the same story world, but recast the plot structure or the film’s moment-by-moment flow of information (that is, its narration). Or try choosing a different genre. For The Wedding Banquet, James turned the original script, a melodrama, into a situation derived from screwball comedy.

Down in the mosh pit

Jim Carrey in Eternal Sunshine of the Spotless Mind.

James has been both an independent producer, in partnership with Ted Hope at Good Machine during the 1990s, and a specialty-division producer with Universal for Focus. The moment of passage for him came when, rewriting Ang Lee’s first feature, Pushing Hands, James realized that he had to get the whole project in shape for filming. After that, and The Wedding Banquet and Eat Drink Man Woman, producing followed naturally.

When James started, a single person could cover most producer duties on an indie film, but now it’s very difficult. Finding material, gathering money, signing talent, checking on principal photography and post-production, planning marketing and distribution across many platforms, tracking payments after release—it’s all a daunting task for one individual. Today an indie movie may list seven to twenty producers. Some probably helped by finding money, some worked especially hard to get material, and a few just slept with somebody.

A traditional producer’s job is to keep the budget under control. Today, with digital filming making special effects cheaper, screenwriters and directors think naturally of more elaborate visuals. This can work with something like Take Shelter, James suggested, but on the whole he thinks that directors shouldn’t jump to extremes. He recalled that using “handcrafted effects” cut the original budget of Eternal Sunshine of the Spotless Mind by a third, and that led to more unusual creative results, like outsize sets and in-camera trickery.

The “independent cinema” scene has always been quite varied. Again James had recourse to history: in the 1960s both United Artists and Roger Corman were labeled independents. The artier independent side developed through the infusion of foreign money and new technology. From the 1970s onward, overseas public-television channels invested in US films by Jarmusch and others, while cable and home video needed product and so financed or bought indie projects. The video distributor Vestron, for instance, could not acquire studio films, so, armed with half a billion dollars, the company began generating its own content. In the same era, pornography was shot on 35mm, and many crafts people learned in that venue and transferred their skills to independent cinema.

Today, however, the indie market is both more fragmented and more fluid. The spectrum space between tentpole Hollywood and DIY indies is being filled by net platforms and cable television. James pointed to the ease with which Lena Dunham moved from Tiny Furniture to the HBO series Girls. Downloading and streaming add to the churn. IFC and Magnolia distribute films, but these companies are owned by cable channels and hold theatrical venues as well. They acquire scores of new films a year, using theatrical releases to get reviews that can support VOD and DVD. Focus can tier its marketing in similar ways, using DVD and VOD outlets to lead viewers to content online under the rubric Focus World.

These new “paramarkets,” James suggests, are porous, overlapping, and still evolving. Traditional windows, he says, have become a mosh pit.

James had a lot more to say, and I expect to be referencing more of his ideas on VOD in a blog to come. But this gives you a taste of the energy and breadth of his thinking. He’s constantly busy but never less than enthusiastic and generous. He always has time to share ideas about anything, from politics to cinephilia. The most exhilarating thing about talking with him is that you know more excellent work lies ahead.

Apart from titles I’ve already mentioned, James Schamus’ screenplays include The Ice Storm, Ride with the Devil, Taking Woodstock, Crouching Tiger, Hidden Dragon, and Lust, Caution, Films that he produced and/or distributed include Poison, The Brothers McMullen, Safe, Walking and Talking, Happiness, The Pianist, 21 Grams, Lost in Translation, Shaun of the Dead, A Serious Man, Coraline, Brokeback Mountain, The Motorcycle Diaries, Eastern Promises, Atonement, Reservation Road, In Bruges, Milk, Sin Nombre, Greenberg, The Kids Are All Right, The Debt, Pariah, Tinker Tailor Soldier Spy…and plenty more.

Schamus provides a video review of the top ten Focus titles chosen by viewers for the company’s anniversary.

J. J. Murphy blogs about screenwriting, the avant-garde, and independent film here. His most recent book is The Black Hole of the Camera: The Films of Andy Warhol.

More on the concepts of story world, plot structure, and narration can be found in “Three Dimensions of Film Narrative,” in my book Poetics of Cinema. A brief account is here.

James Schamus lecturing, University of Wisconsin–Madison Center for the Humanities, 19 April 2012.

One summer does not a slump make

Kristin here:

Nor does an entire year. Yet at the end of 2011, the press was trumpeting the fact that the film industry was suffering a slump that might become permanent. After all, “the movies are in a slump!” makes for more catchy copy than “the movies have sunk back to normal” or “the movies are in a downturn from which they will probably recover.” The Hollywood Reporter went for a particularly dramatic approach to year-end coverage of the slump, as evidenced by the title/illustration (see above) of Pamela McClintock’s analysis, appearing in the January 13, 2012 print issue and online.

McClintock cited a number of factors. Young people are no longer going to the movie theaters. The studios are too dependent on big, familiar franchise pictures: “But exhibitors worry that moviegoers are growing impatient with Hollywood’s love affair with the familiar and shortage of original ideas (hello, Avatar!). In 2011, for the first time ever, all of the 10 top-grossing films domestically were franchise titles and spinoffs.” (But wouldn’t that mean that moviegoers are more than ever thrilled with Hollywood’s franchises?) She cites also the rise in admission costs, with ticket prices going up by 5% from 2009 to 2010.

That reason seems the most plausible. People really are tired of ticket prices that have risen faster than inflation. The industry may have pushed the cost up past a point that makes an evening at the movies seem attractive. If, as seems likely, the industry will raise the cost of 2D tickets rather than dropping the cost of 3D ones, we may see a real slump.

The 800-pound thanator in the room

Hollywood box office has its ups and downs, which is only to be expected. One year the successful releases cluster together; another year, they spread out or drop off a little. Any decline will be seized upon by many reporters as a slump, a sign that people are souring on the movies and turning to the many other forms of pop-culture entertainment available in the digital age.

Careful commentators have pointed out that naturally 2011 would be lower than 2010. As the AP’s film reporter, David Germain put it at the end of 2011, “An ‘Avatar’ hangover accounted for Hollywood’s dismal showing early this year, when revenues lagged far behind 2010 receipts that had been inflated by the huge success of James Cameron’s sci-fi sensation.”

Just how much did Avatar affect 2010’s box-office total? The film achieved a worldwide total gross of $2,782,275,172. Of that $1,786,146,809 came in during 2010. That’s comparable to, say, two Harry Potter films.

Predictably, Avatar ran for a long time. It was released on December 18, 2009 and ran for 238 days (34 weeks), closing on August 12, 2010. Naturally its most intense box-office period in 2010 would have been in the early months. Alice in Wonderland opened on March 5, on its way to crossing a billion dollars in international gross. This was a highly unusual synchronization of steamroller films. Still, in early 2011, the fact that the box office was off 20% from 2010 was immediately proclaimed as a signal of doom and gloom to come. Richard Verrier and Ben Fritz suggested that, putting aside some under-performing films, “even hits like Justin Bieber’s ‘Never Say Never,’ ‘The King’s Speech’ and ‘Battle: Los Angeles’ pale in comparison with the early 2010 blockbusters ‘Avatar’ and ‘Alice in Wonderland.’” Given that the first few months of the year are typically the dumping ground for films deemed unlikely to set the box-office on fire, early 2011 was a return to business as usual. Avatar and Alice in Wonderland hardly made for a realistic comparison.

The tentpole effect

We’ve seen that Avatar’s 2010 box office was comparable to two major blockbusters. Now consider the fact that two films released in 2010 grossed over a billion dollars each: Toy Story 3 ($1,063,171,189) and Alice in Wonderland ($1,024,299.904). (Here and throughout this entry, the amounts are given in unadjusted dollars.)

That’s the equivalent of having four very high-grossing films in one year. The only other time a similar pattern emerged was in 2002, when four of the top franchises brought forth a film: Spider-Man ($821,708,551), Harry Potter and the Chamber of Secrets ($878,979,634), The Lord of the Rings: The Two Towers ($926,047,111), and Star Wars: Episode II – Attack of the Clones ($649,398,328). It was a perfect storm that has so far not been repeated.

These are exceptional years, so one would expect the box-office to sink afterward. Yet somehow the industry and the world of entertainment journalism see years with such big box-office spikes as forming the new norms against which all other years should be judged. Studio executives seem to think that 2002 or 2010 indicate a realistic goal that they could achieve all the time, if only they could put out the right films. Almost inevitably, articles on declines in box office end with the notion that the films released in that particular year or quarter were just not appealing enough. But of course, there’s no way to deliberately achieve such a combination of blockbusters. Many blockbusters fail, and the big special-effects-laden ones take years to lumber through production. By sheer coincidence, some blockbusters converge.

The lesson to be learned here is that the really big films make so much money that just a few of them–or one James Cameron epic–can by themselves create the sense of the entire Hollywood output going way up or way down. They average out. If Hollywood attendance is dropping, it’s happening very slowly. Other factors are making up for that gradual attrition, as we’ll see below.

2002 was 2002

Journalists in particular have long been using 2002 as a benchmark to measure how badly Hollywood has been doing since. Ben Fritz and Amy Kaufman, in an otherwise good analysis written for the Los Angeles Times, resort to this comparison: “The box-office figure known in the industry as the ‘multiple’—the final box-office take compared to a movie’s opening weekend ticket sales—has dropped 25% since 2002.” The 2002 figure might have been skewed slightly by the fact that the three parts of The Lord of the Rings had an extraordinarily high incidence of repeat viewings and hence were in first run far longer than most films. For The Two Towers, the opening weekend was 18.2% of its total domestic gross (up from 15.1% for the previous part, The Fellowship of the Ring, which was in first run from mid-December, 2001 to August, 2002, half a week longer than Avatar). Spider-Man’s opening was a more typical 28.4% of the total; Attack of the Clones was 26.5%, and Harry Potter and the Chamber of Secrets, 33.7%. A more recent film with above average repeat business, Inception (2010), drew only 21.5% in its opening weekend. With Iron Man 2 (2010), the opening was 41.0% of the total gross. Good word of mouth is another possible explanation for some films’ steady or even growing performances after their opening weekends. By the way, the fact that Fellowship of the Ring was in theaters for seven months in 2002 boosted the total box-office beyond the rise created by the four franchise films that premiered within that calendar year.

It’s not clear that the growth in the proportion of the box-office take represented by the opening weekend is directly related to the drop in attendance, as Fritz and Kaufman suggest. One might instead point to the growth in the number of screens, with new megaplexes opening and existing ones adding screens. In 2002 there were 35,500 US screens, but by 2011 there were over 39,300–an increase of nearly four thousand screens. They provide more exposure to the title on opening weekend.

Further evidence is the expansion of opening weekend releases. It was unheard of in the early 2000s to have even a major blockbuster open on 4000 screens. Now it’s not uncommon. At its widest release, The Two Towers was in 3622 theatres, while Iron Man 2 was in 4390. With that many theaters, the number of people able to get tickets for the opening weekend grows, which means that, unless a film generates significant repeat attendance or excellent word of mouth, the box-office take will fall off more rapidly than it used to. But the fall-off doesn’t necessarily mean that fewer people have bought tickets.

Oops! Never mind

The story of the slump suddenly began to look very different as soon as the new year began. At the end of February 2012, Variety reported that domestic box office for the first two months was up 21% over the same months of 2011. It so happens that in the same period of 2011, box office was down 20% against the early months of 2010. And the early months of 2010 saw Avatar going very strongly after its mid-December debut.

The Variety article’s author, Andrew Stewart, pointed out the fact that Avatar had unbalanced the 2010 results. He also pointed out that the fast start out of the 2012 box-office gate resulted from a larger number of films making less on average. But this year’s likeliest high-grossers are yet to come: The Hunger Games, The Dark Knight Rises, and the first part of The Hobbit, with The Bourne Legacy and The Amazing Spider-Man possible mega-hits as well. There are also new films in the Madagascar, Ice Age, and Men in Black franchises coming out. Ann Thompson weighed in a few days after Stewart, pointing out that the increased number of films was not necessarily a problem, since more theaters are being built at a fast clip around the world. More theaters theoretically need more product. (More on that below.)

But an important point about the early hits of 2012 is that they were relatively modest films. They could have been expected to earn far less than blockbusters but still perform well in relation to their production and distribution costs. The Vow, the first film of the year to cross $100 million, is a romance; Safe House a Denzel Washington thriller; and Journey 2: The Mysterious Island a mid-budget family adventure film. This is pretty much what a normal, non-Avatar year looks like early on. (In 2008, David wrote about one early-in-the-year release that was a modest hit, Cloverfield.)

Soon thereafter Chronicle, made on an announced $12 million budget, had pulled in about ten times that internationally and proven that young men, contrary to industry fears, were still willing to go to see movies in theaters. Then The Lorax became the first iron-clad blockbuster. Neither of these is part of a franchise. Talk of a 2011 slump has disappeared. I suspect it may resurface a year from now as a benchmark showing how extraordinarily well Hollywood films did at the box office in 2012.

The 3D effect

2009 and 2010 were the best years for 3D, with Avatar not only dominating world film screens but also luring producers to imitate its success. But in 2011, the advantage provided by the higher ticket prices that 3D permitted began to fade. Last summer I discussed the decline at some length, here and here. I won’t rehash that here. In 2009, 3D films made on average 71% of their box-office grosses from 3D screens, and in 2010 the figure was 67%. In 2011, 56% of business for 3D films came from 3D screens.

The decline may represent the end of the novelty appeal of 3D, as well as the increasing number of 3D films competing in the market. Anecdotal evidence suggests that moviegoers are tired of paying premium prices. The fact that 3D animated features took in a slim one-third of their grosses from 3D screens in 2011 suggests that the cost of a whole family attending together, especially if the younger children can’t keep the glasses on, has begun to hamper the format.

Thus 3D may have contributed to an artificial, temporary rise in total box-office figures in 2010. This would inevitably be reflected as a decline in 2011, as more people opted for 2D screenings of popular films.

(Figures from Screen Digest, February, 2012, p. 37.)

It’s a big, wide, ticket-buying world out there

All the box-office reports and prognostications discussed above are based on domestic box-office grosses, which in practice means the USA and Canada. But in parallel to the reports of a slump in 2011 BO figures, there were reports of impressive growth in foreign film markets.

Take the United Kingdom, traditionally a top consumer of Hollywood films. 2011 saw the total box-office gross surpass £1.5 billion for the third straight year. That total grew by 5% over 2010. Films from Hollywood’s Big Six studios took 74% of the market. Local productions had a particularly good year, with three in the top ten: The King’s Speech, The Inbetweeners Movie, and Arthur Christmas. Even if that success continues, however, Hollywood will have a healthy share of the market.

More generally, Variety announced in mid-January, “It was business as usual at the 2011 international box office. And business is booming.” (“International” refers to all markets apart from the USA and Canada.) The Russian market is growing quickly, with its total gross of $1.16 billion in 2011 representing a rise of 20% from 2010. Russian films make up only 14.7% of the market, with the rest mostly coming from Hollywood.

The Chinese market is huge, passing $2 billion for the first time in 2011, up 29% over the previous year. (See below.) There is a Chinese quota of 20 foreign films per year, but a recent decision to allow more 3D and Imax films in may herald a gradual opening of the market. Certainly the blockbusters that make their way into China are popular. According to Hollywood Reporter, for the first time, China was Paramount’s highest grossing foreign territory, with $303 million at the box office, largely thanks to Transformers: Dark of the Moon. Still, China yields only about 15 cents on the dollar back to the distributor, a situation likely to change only slowly.

Brazil, India, and Eastern Europe have seen healthy expansion as well.

Even Hollywood comedies, notoriously hard to sell abroad, are becoming more popular. In 2011, Bad Teacher, Just Go With It, and Friends With Benefits all made around $100 million outside North America. Very unusually for comedies, they also grossed more money abroad than domestically.

The major studios’ box-office grosses abroad were: Paramount, $3.19 billion; Warner Bros., $2.86 billion; Disney, $2.2 billion; Fox, $2.15 billion; Sony, $1.83 billion; and Universal, $1.3. (These figures represent the total amount paid for tickets; only a portion returns to the studio.) I take this information from Hollywood Reporter, which notes that the big studios are increasingly buying local, foreign-language films to distribute within those domestic or regional markets.

There’s more to Hollywood than tickets

One might conclude from all the stories about the box-office slump of 2011 that the big studios’ profits would be down, at least a little. Actually, a studio had to work hard not to see profits rise last year. That’s partly because they make things other than movies and partly because movies make a lot of money that has no direct connection with theatrical distribution.

The February 24, 2012 issue of The Hollywood Reporter published a helpful summary, “2011 Profitability: Studio vs. Studio.” (The online version is behind a paywall.) As the authors point out, the studios calculated their profitability on different criteria, so direct comparisons among them are difficult. Nevertheless, the article shows that most studios were profitable and suggests why.

Time Warner’s filmed entertainment wing had a 15% rise in profits from 2010 to 2011. That resulted in part from the release of the final Harry Potter film. Beyond that, however, there was the fact that WB now manufactures video games and shipped 6 million copies of Batman: Arkham City. (That game wouldn’t exist without the film series, so we see synergy at work here.) It also produces over 30 TV programs, including The Big Bang Theory and Two and a Half Men.

News Corps.’s film studio, Twentieth Century Fox, saw profits rise 9%. Rise of the Planet of the Apes boosted the bottom line, but so did strong home-entertainment sales. The TV wing produced Glee and Modern Family. “Films licensed to pay TV and free TV helped, as did digital content-licensing deals. The TV licenses are estimated to have been worth about $200 million in the second half of the year.” Thus quite apart from their box-office takings, films made a lot of money for the studio.

The profit from Sony’s film unit jumped an impressive 95%. $278 million of that was a one-time sale of merchandising rights for the new Spider-Man movie. The Smurfs was the studio’s top earner at the box-office, and according to The Hollywood Reporter, “The division also benefited from stronger-than-expected DVD sales of The Green Hornet and Battle: Los Angeles.”

Disney was the only studio to face a decline in profitability. Its profits slipped 20.5%, though they were hardly meager at $656 million. The disappointments of Mars Needs Moms and Cars 2 are largely to blame. Disney’s current attempt to create a new blockbuster franchise in John Carter clearly won’t reverse the trend.

Paramount’s profits were the lowest but improved the most in 2011: 128%. The growth seems due largely to the Transformers franchise and high income from a 2010 deal between Epix (Paramount’s 51%-owned VOD channel) and Netflix.

The Hollywood Reporter was unable to obtain figures for Universal.

This overview hints at the underlying factors that make assessing the health of the film industry through box-office figures alone a shaky process. Ideally we would have figures on DVD and Blu-ray sales, as well as on licensing deals for streaming and other digital distribution systems. But this information isn’t made public by the studios.

The uncertainties and appeal of post-theatrical markets

This is a pity, since the real crisis facing the film industry today is not fluctuations in box-office income. It’s how to deal with the rapidly changing post-theatrical revenue stream: the sudden proliferation of other ways to sell or rent films for viewing on the tablets, game consoles, cell phones, computers, and other devices now driving the death of tape- or disc-based home entertainment. Studios see new ways to make money and are at war with exhibitors about how short a window there would be between theatrical release and the various forms of video release.

Early in this proliferation of online-based distribution, studios continued to concentrate on selling DVDs and later Blu-rays. They licensed the rights to rent films on DVD or via streaming to Netflix and other companies. Now they’re beginning to realize that they don’t need the middleman, but they haven’t found models for handling all forms of post-theatrical distribution themselves. In the meantime, Redbox kiosks rent DVDs for a pittance and make the home-video experience seem like something that barely needs to be paid for–and certainly isn’t an Event.

The decisions the studios make about post-theatrical are crucial to the health of the film industry. Movie City News publisher David Poland recently summed up the situation, pointing out that the theatrical release is still far and away the biggest single generator of income per viewer for the industry. His essay is worth reading in full, but here is the gist in terms of how home-entertainment revenues relate to theatrical income:

1. Post-theatrical is already a blur for consumers and it will only get more so. People will expect access at all times on any device for a low, low price… either in a subscription model or a per-use price point of $2 or less.

2. Theatrical will soon be the ONLY revenue opportunity that stands apart from that post-theatrical blur. No other revenue stream will ever again generate as much as $10 a person… or even $5.50 per person.

3. Consumers adjust to whatever window you offer. But history tells us, the shorter the theatrical-to-post-theatrical window for wide-release movies, the more cannibalism of the theatrical.

4. Just as the DVD bubble could not be pumped back up after it was deflated by pricing aggression, theatrical will not survive a significantly shorter window to post-theatrical as we now know it… and once it is broken, it will not be able to be fixed. And that revenue stream will NOT be replaced by what is now post-theatrical. It is simply money that will be lost, never to be recovered.

Theatrical will never be The Drink again. You’re looking at a 2 month window for most studio films vs decades of post-theatrical revenue opportunities. It’s not an even fight. But take a deep breath and look at the obvious… for theatrical to still be as much as 40% of the revenue of a studio film is bloody amazing. It’s not the past. It’s not ’39 or ’69 or even ’89. But it’s a LOT of money. And it is insane to take it for granted or to dismiss it, because there is no proof out there that I have ever heard that suggests that theatrical revenues gets in the way of post-theatrical revenues… only the other way around. Why? Because theatrical is the unique proposition. It’s post-theatrical that really has to compete with EVERYTHING the world has to offer.

(David’s post came in response to one by Mike Fleming on Deadline.)

If the studios start selling their films in various digital forms for a dollar or two, and do so in ways that cannibalize the theatrical market, there will come a point where many people stop going to theaters and stay home to do their movie viewing. So there will need to be many more purchasers of that film than there currently are to make up the difference between that cheap sale and the price of a movie ticket. Without a boost in consumers, post-theatrical income would fall, and the studios wouldn’t be able to afford to make the sorts of films that currently generate the most money.

Whether David’s analysis is too pessimistic remains to be seen. But he points to a far bigger problem than a largely illusory drop in box-office figures.

Jumping to conclusions

The notion that 2011 saw a serious slump results from comparisons that make for catchy headlines. But sometimes a situation can prove misleading. Consider the title of a Variety article from February 23 of this year: “Imax profit plunges to $6.3 million.” Can this be the end of Imax? Yet read on:

Imax profit fell last quarter to $6.3 million from $54 million, mostly on a major tax benefit the year before. Revenue eased by $2 million to $67 million.

Without the tax and other items, income fell to $9 million from $14 million, in line with expectations given a soft box office.

The company said 2011 was a year of record signings and installations, with 497 Imax theaters installed in commercial multiplexes, up 33%, led by China, Russia and North America. CEO Rich Gelfond said the company will add focus on South America, including four new theaters in Brazil, Western Europe and India, where a recent deal will bring Bollywood titles to Imax. It will expand local film production from China into Russia and France.

(Note: The title of this story was subsequently changed to “Imax, Dish, Liberty stocks rise” when it was revised to add the fact that Imax’s stock rose 4.5% on the above news.)

The moral is, the obvious interpretation is not always the correct one. The implication of box-office fluctuations needs analysis beyond a simple comparison of ups and downs from one year to the next.

Moviegoers at the Super Cinema World in the Metro City shopping mall, Shanghai, China